Month-End Analysis

October 2025

Disclaimer

The data I use (BitInfoCharts, Coinglass, CoinMarketCap) to compile the tables and graphs contained in the on-chain section of this analysis do not always align with data found via others sources like Glassnode and CryptoQuant. I cannot explain the reason for the differences nor can I confirm which sources are most accurate. For this and other reasons, I have come to trust only the on-chain data I collect when trying to explain and/or predict Bitcoin’s (BTC) future price action (PA). Whether you too find my on-chain analysis useful is for you to decide, but I can assure you some of my observations and/or predictions will differ, often markedly, from other observations and/or predictions you will see on Crypto Twitter (CT) and elsewhere.

Price Action

Open (Coinbase): $114,068

High (Oct 6): $126,296

Low (Oct 17): $103,517

Close: $109,555 (-3.96%)

After screaming almost 10% higher the first six days of October and reaching a new all-time high (ATH) of $126,296, BTC momentum fizzled and then faceplanted, reaching a low of $103,517 on October 17 before finally closing at $109,555, down 3.96% overall. While 4% lower month-over-month is a relatively modest move down, the intra-month volatility was especially challenging for BTC bulls, with price dropping a whopping 18% from peak to trough.

Tables

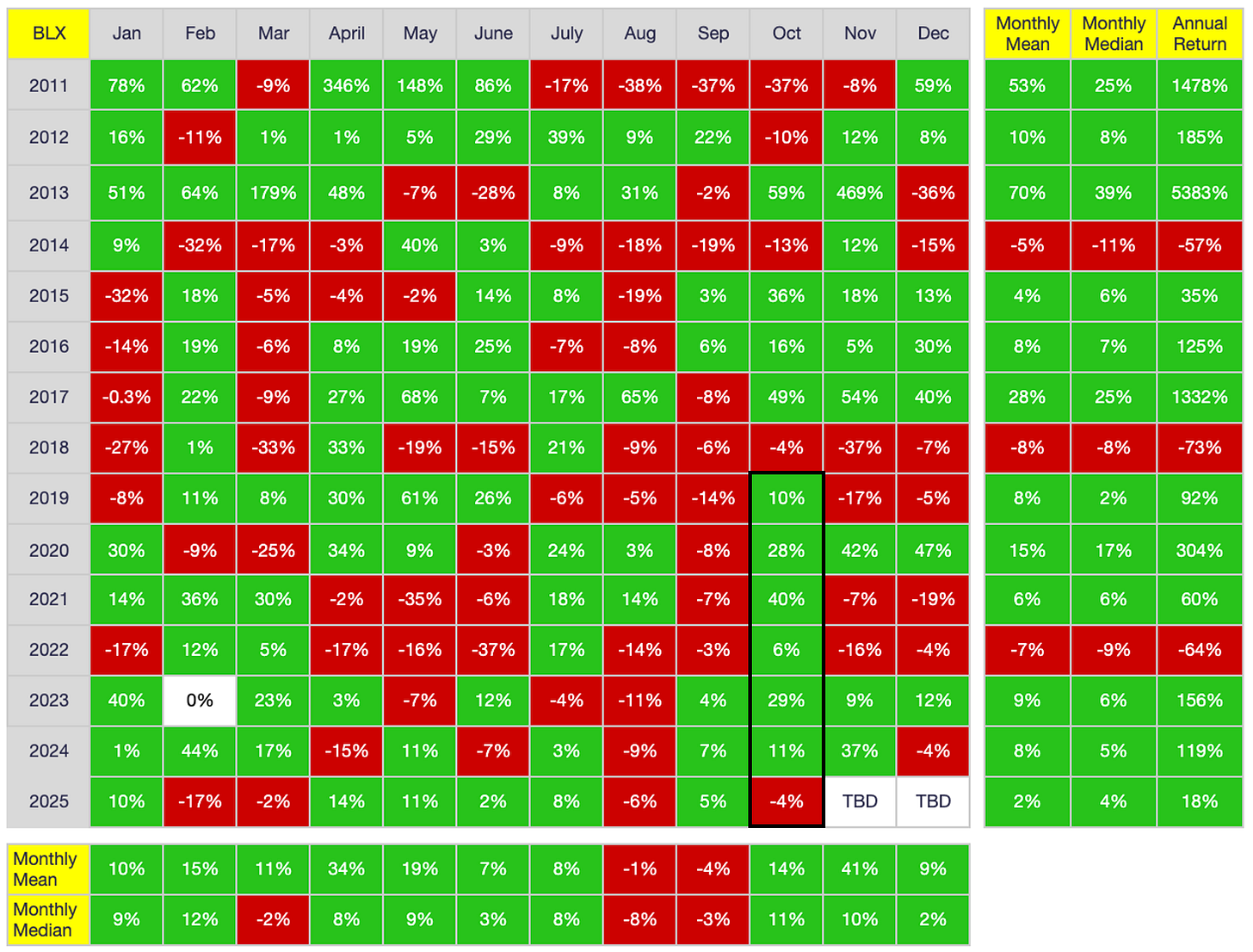

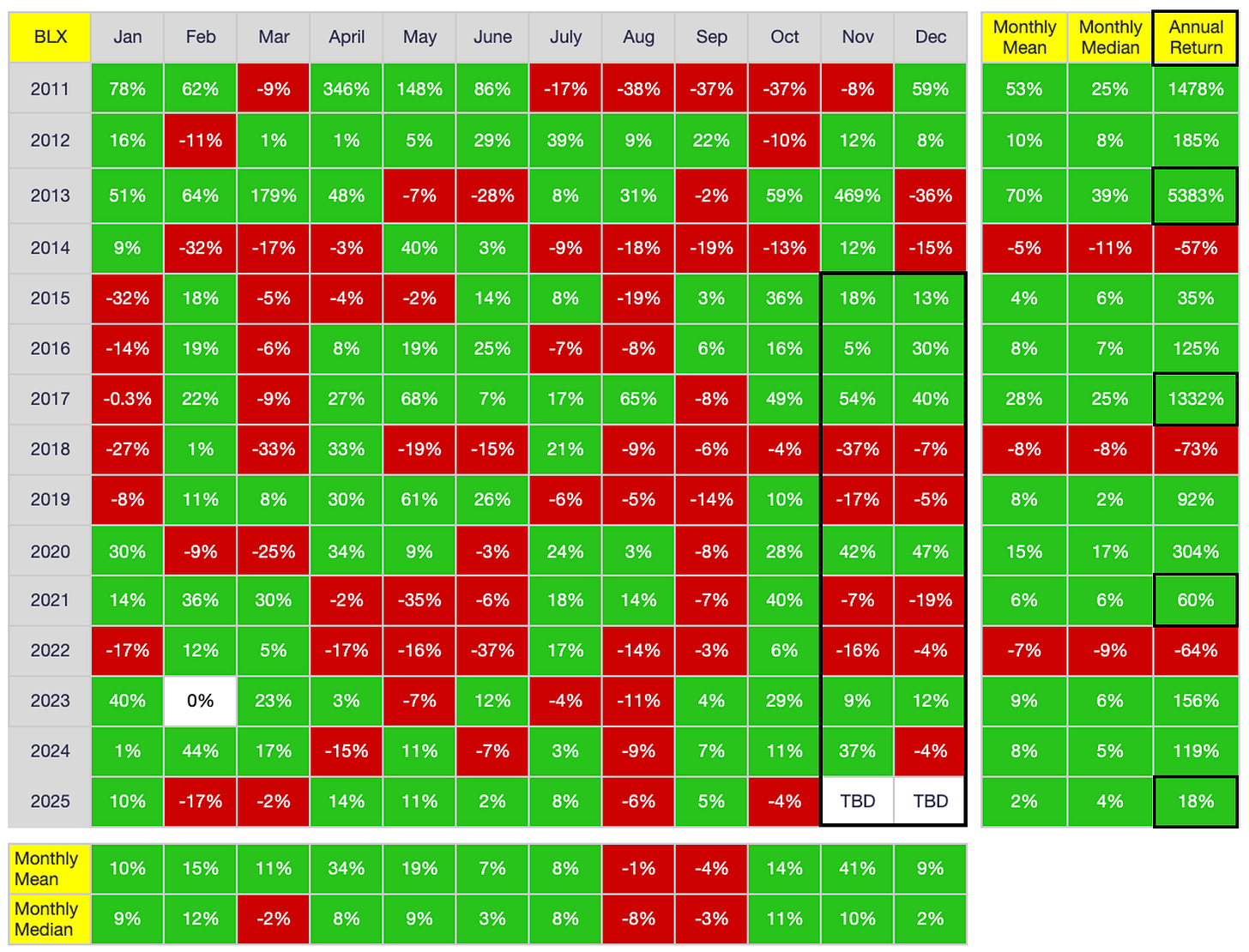

Calendar-Month Returns

With its 4% drop, Uptober is no more, snapping an October win-streak of six consecutive years. In hindsight, a contraction in October was arguably overdue, at least from a calendar-month perspective, given that six consecutive up years (October 2019-2024) was already tied for the longest calendar-month win streak in BTC history (along with November 2012-2017). Other than that, BTC has rallied five consecutive years only two times (Feb 2015-2019 and April 2016-2020); all other calendar-month win streaks have been four years or shorter (NB: BTC has closed lower six consecutive years only once, September 2017-2022, and five consecutive years twice, January 2015-2019 and March 2014-2018). In short, a price increase this October would have been unprecedented, so perhaps we should have seen a contraction coming. That said…

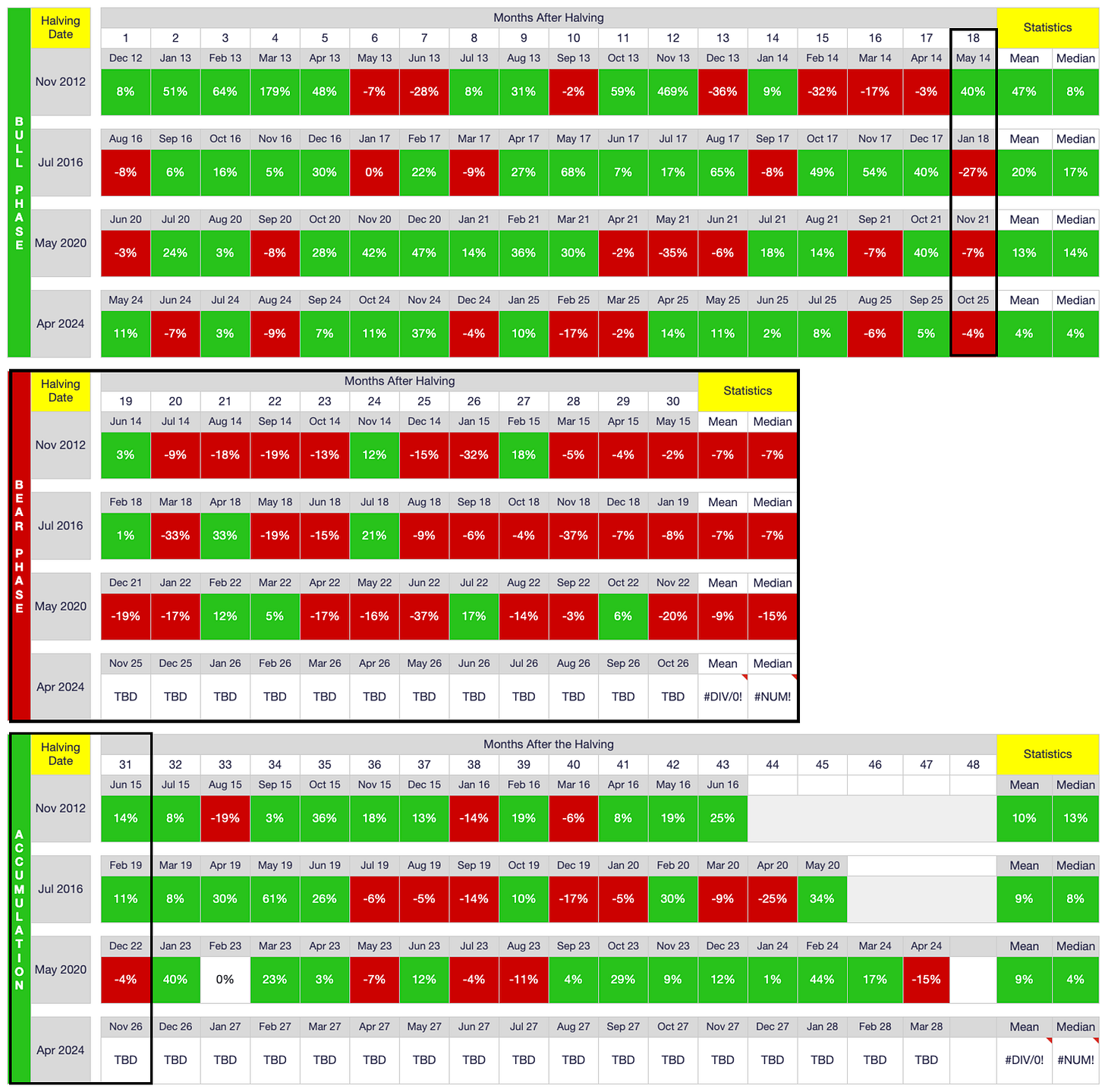

Halving-Cycle Returns

As shown above, October 2025 was the 18th month of the halving cycle and theoretically the final month of the bull phase before commencing a 12-month bear phase. Also as shown above, however, this is the third cycle in a row where price actually closed lower in Month 18. In this light, price was more likely to roll over in October than not despite me including Month 18 as part of the bull phase. i.e., I was suffering from a “halo effect,” a term used in academia to describe a researcher whose objectivity has been compromised because their perspective on one trait/result has unduly influenced their perspective on other traits/results. In this case, I have been including Month 18 as part of the bull phase of the halving cycle because of the whopping 40% return in May 2014, despite the fact that Month 18 closed lower the subsequent two cycles. And now October 2025 makes three. Shame on me. I will update my halving-cycle table from next month.

In short, I should have foreseen a contraction in October due to the fact that seven consecutive up years is unprecedented from a calendar-month perspective and Month 18 of each halving cycle actually closed lower the previous two cycles. Alas, I did not. Perhaps more importantly, however, is what happens next.

Is this time actually different?

Many people have been claiming this cycle is different, that the four-year halving cycle no longer matters, that global liquidity is the only thing that matters, etc. (see Exhibits A, B, C, D, E, F, G, etc). All of these narratives may indeed prove true, and I for one certainly hope they do. i.e., I am a BTC permabull, all but certain that BTC is the future of money, eventually becoming both the globe’s preferred store of value (replacing gold) and preferred medium of exchange and unit of account (replacing the US dollar). However, this halving cycle has unfolded EXACTLY like every other halving cycle thus far, so why is everyone so quick to claim this time is different?

i.e., There is ZERO evidence thus far that this cycle is actually different from any other cycle, at least not yet. And given that I have been an active investor since the mid-1990s, listening to era-respective investors argue why the dotcom bull market of the late 1990s was different, why the housing bull market of 2005-2007 was different, and why the COVID-pandemic bull market of 2020-2021 was different, perhaps you will forgive me for at least wanting to see a shred of evidence that the current bull market is actually different than every other recent bull market. i.e., Is this bull market actually different? Or will it, in hindsight, merely end up being the AI bull market of 2024-2025, ending in a spectacular implosion just like every other bull market of the past 30 years?

Again, I hope this time actually is different. I really do. But there is simply no evidence yet that it is, which is why the next five months (November 2025 through Q1 2026) are critical. November and December 2025 PA is critical for the following reason:

Revisiting the calendar-month table again, note above how December PA has trended in the same direction as November PA every year since 2015 except for last year, when PA took a 4% breather in December after a whopping 37% climb in November. i.e., For whatever reason, the two final months of the year seem to trend in the same direction much more often than not, at least over the past decade. In this light, if November closes higher, then it would be reasonable (even logical) to assume December will as well. Conversely, if November closes lower, then December likely will as well.

Why this trend matters is because if both November and December close higher, then BTC will have achieved yet another new ATH, later than ever before in a halving cycle, thus providing the first evidence that this cycle actually is different.

On the other hand, if November closes lower, then it is reasonable (even logical) to assume December will close lower, thereby providing even more evidence that the cycle remains in tact, and that, no, there is absolutely nothing different about this cycle than any other cycle, influencer claims notwithstanding.

Interestingly, my gut is telling me that November will close higher but December will close lower, and that no new ATH will be reached, meaning I foresee bulls making one more run at the ATH in November, but that it will fall short and the bear phase will commence in earnest in December. Will I be wrong? I certainly hope so. But do I think I will be? Why would I? Once again, this cycle has unfolded EXACTLY like every other cycle thus far, so why would it be different? I need to see some evidence that it’s different, and such evidence is utterly absent right now, at least thus far.

To this end, and in full disclosure, I sold 25% of my stack in October in anticipation of the start of the bear phase and will sell up to another 25% in November/December depending on how PA unfolds over the next two months. My reasoning is simple: if I am wrong and this time actually is different, then I will still be 50-75% invested, meaning I will still be able to take advantage of any prolonged bull market, even if not to as great an extent as I would have been able to had I remained fully invested. On the other hand, if this time is not different, then I will have a truckload of cash to invest later, hopefully at the nadir of the bear market, just like I did last cycle.

The problem with my strategy last cycle is that I fell for the “this time is different” narrative, not selling the majority of my position until BTC neared $40K (more than 40% lower than the ATH of $69K). As a result, I had far less capital to invest at the depths of the bear market than I would have had if I had followed my instincts about the four-year cycle rather than listening to influencers. That will not happen again.

More specifically, I intend to remain 75% invested for now and use the 25% cash I have to trade in and out of the market so long as the bull market persists. i.e., If price does no worse than chop up and down while remaining above $100K throughout November and December, I will make a fortune simply because I know how this market works in the short-term better than I have ever known any other market in my 30-year investing career. Or, if even better the bull market resumes and we do achieve yet another ATH, then I will still be 75% invested and can still profit to some extent with my other 25% because I will repeatedly jump in and out using my short-term trading strategies.

If on the other hand the market does indeed roll over in November or December and does not recover, and/or price drops below $100K for more than just a moment’s time, then I will sell up to 25% more of my position so that I have up to 50% in cash to reinvest at the depths of the next bear market, which mark my words, will eventually come. FYI, for those interested, the nadir of the next bear market will arrive in October or November 2026 if the four-year halving cycle remains in tact.

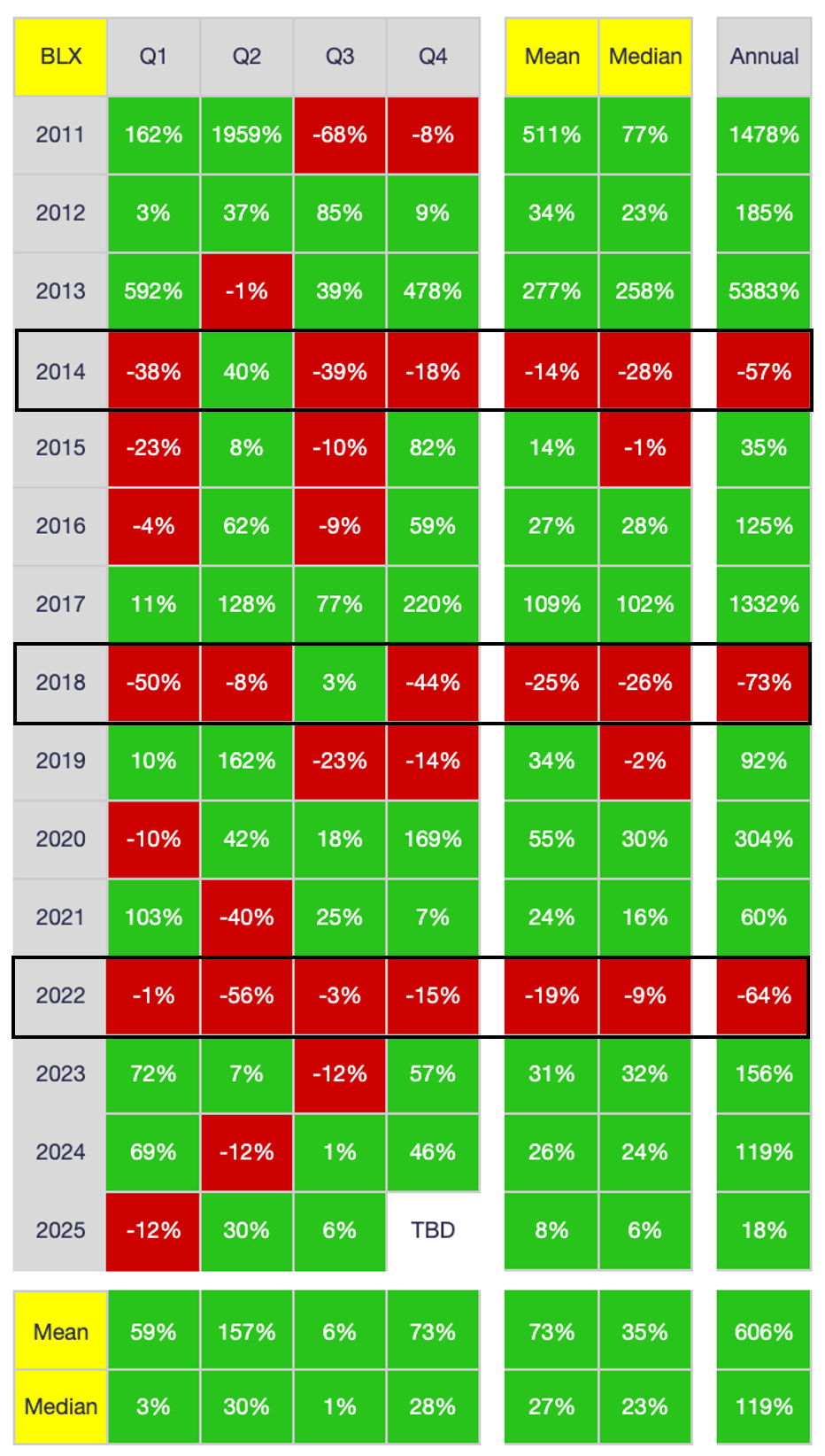

I had mentioned above that Q1 2026 is also important, in my opinion. The reason for that, irrespective of what happens in November/December 2025, is that Q1s are typically strong quarters in bull-market years and weak quarters in bear-market years (not only in BTC but also other markets, principally US equity markets).

As shown above, every Q1 of each BTC bear-market year (2014, 2018 and 2022) has closed lower, as have nearly all quarters of those three years (the exceptions being Q2 2014 and Q3 2018). As such, IF the halving-cycle rhythm holds, then both Q1 2026 and 2026 as a whole will close lower, substantially lower, than the 2025 year-end price, whatever that proves to be.

Having said that, as shown above, there are some exceptions to the rule, where BTC actually closed lower in Q1 of 2015, 2016, 2020 and 2025 yet managed to close the year higher (yes, I realize there are still two months remaining in 2025). i.e., Even if Q1 closes lower, there is no guarantee the rest of the year will be bearish as well. Fair enough. But again, there is ZERO evidence thus far that the four-year cycle has broken down, so until it does, there is ZERO reason to assume 2026 will unfold any differently than the previous three BTC bear market years.

With this in mind, this is how I personally plan to invest the next five months (NOT financial advice; merely my own investing strategy):

Trade my 25% cash throughout November and December as described above.

If a new ATH is achieved before year-end, remain 75% invested and trade in and out with my 25% cash until the market finally rolls over (whenever that is), and then sell an additional 25% so that I enter the bear market 50% invested and 50% in cash. Then, when everyone is panicking and convinced BTC is dead/going to zero, then I’ll pile back in and sit tight until the inevitable next bull cycle peaks, just like I did/am doing this cycle.

If on the other hand no new ATH is achieved before year-end, then I will sell off more of my position, up to 50%, and then trade selectively all the way down throughout the bear market, which again will presumably conclude by the end of 2026. At that point, I will pile back in just like I did in 2022.

In sum, my goal is to remain 50% invested forever but actively trade up to 50% of my cash position after the market finally rolls over and enters a prolonged bear market (which it absolutely will at some point, whether tied to the four-year cycle or not).

Until I see a shred of evidence to the contrary, I think that time is close. i.e., I think price has peaked for this cycle and will generally chop lower for the next 12 months, eventually dropping below $100K and potentially well below (though not as much as previous cycles, where price dropped 70-80%).

I will certainly share my perspective again in detail when we reach that point, but if I had to guess right now, I think a 60% drop from the current ATH is possible, which would put the bear-market low around $50K, likely near the end of 2026. Again, I will share my perspective more at that time; I first need to see all the “sky-is-falling” comments in my feed before I’ll know for sure when the bottom is finally near. In the meantime, I first need to see how November and December unfold, and then subsequently Q1 2026. Either way, exciting it will be.

Address and Coin Distributions

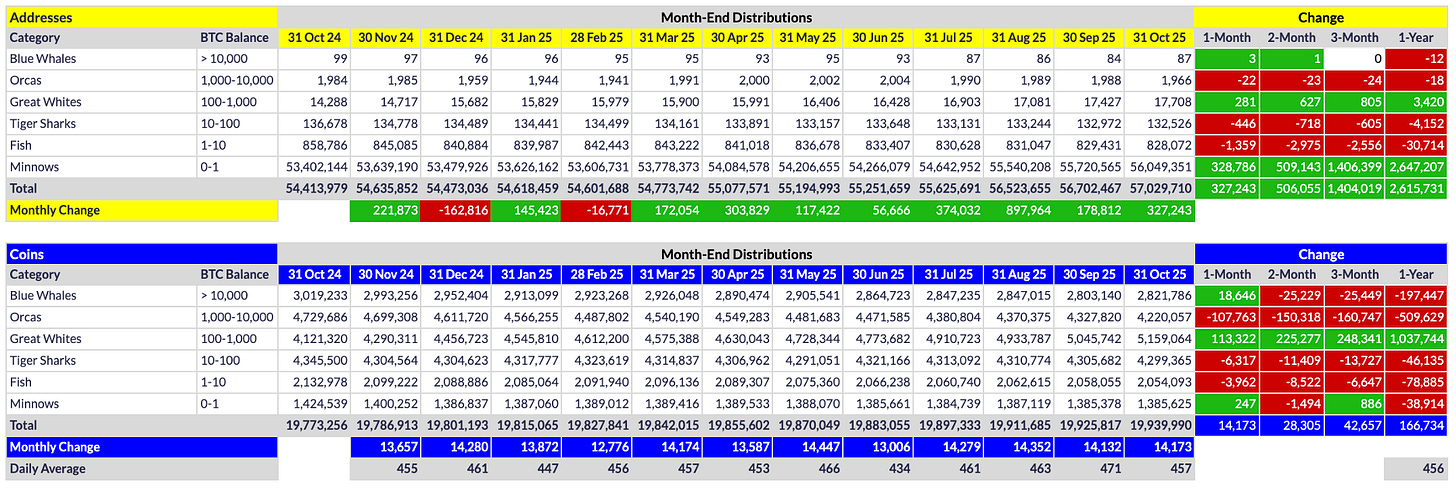

Below are the address and coin distributions for the previous 12 months:

As shown above, three new Blue Whales actually evolved in October, bucking the 2025 trend of contracting month after month. That said, Orcas continued projectile-vomiting coins like there’s no tomorrow, with the single largest monthly drop in both addresses and coins since the 2022 bear market. Many have chalked this up to OG selling; that is as logical an explanation as any. Whoever it is, what is crystal clear is that whales are selling heavily into every pump, and US institutional investors are the buyers, as evidenced above by the ongoing surge in Great White addresses and coins, and below in the relentless growth of US spot-BTC ETFs, particularly IBIT.

Exchange Flows

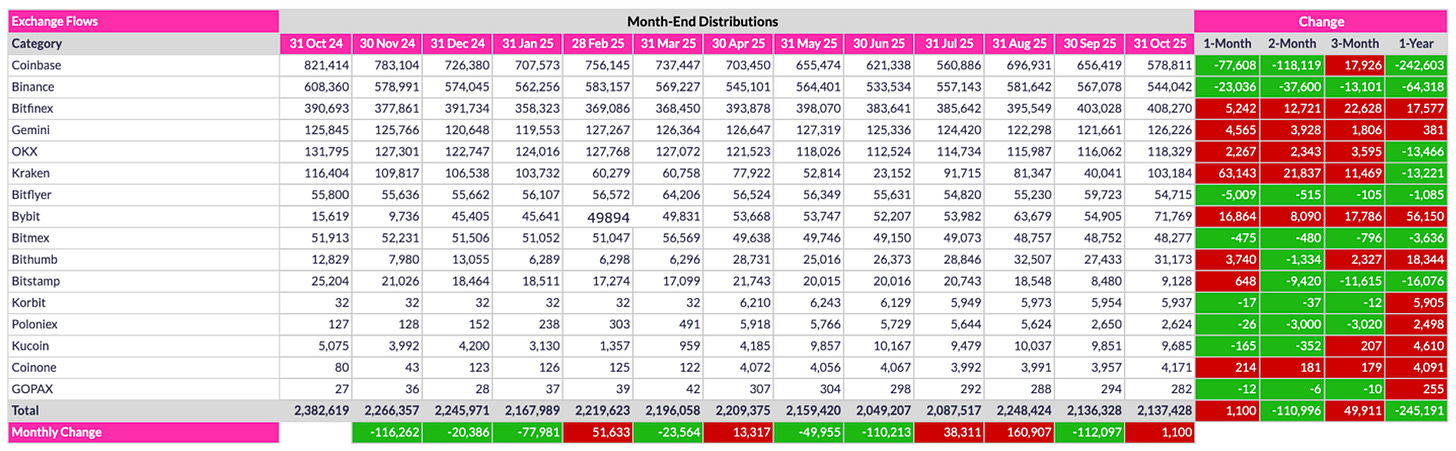

Below are the exchanged flows for the previous 12 months:

As shown above, Coinbase and Binance had monster outflows in October while other exchanges like Kraken and Bybit had monster inflows. Whether these flows reflect reality depends on how much credibility you give to the data furnished by Coinglass, but in my experience, they perform so many wallet scrubs, it is hard to trust the data from any one month. i.e., It makes more sense to monitor long-term trends, and the prevailing long-term trend is steady exchange outflows, meaning more and more coins are moving into cold storage over time, which of course is bullish long term.

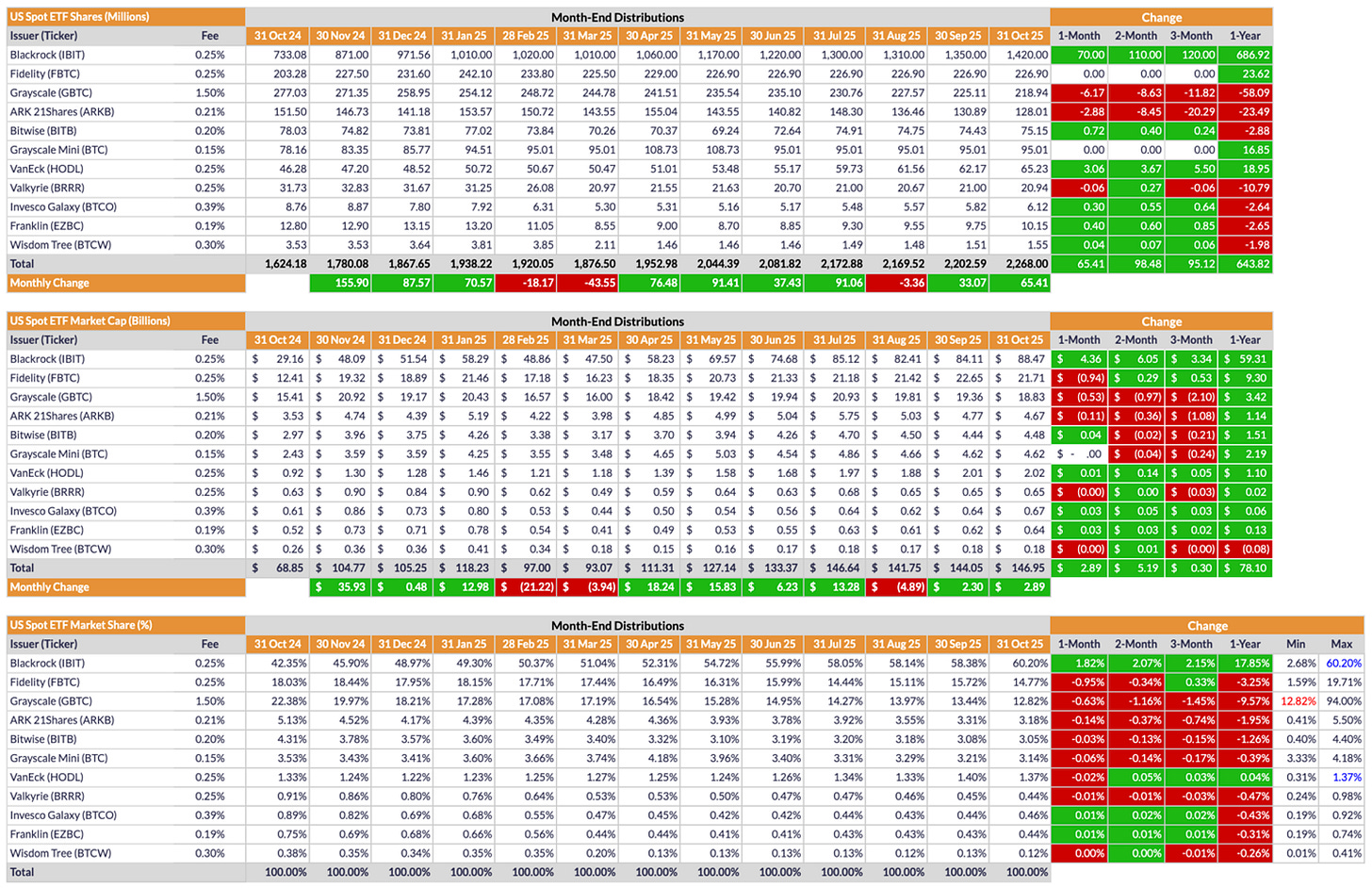

US spot-BTC Exchange Traded Funds (ETFs)

As alluded to earlier, US spot-BTC ETFs continue to see net inflows overall, almost irrespective of BTC PA. Granted, the market is “stable” right now, meaning PA is neither particularly bullish nor bearish, at least on a month-over-month basis. Regardless, it is encouraging that so many US institutional investors are taking positions in BTC, even if only by proxy. IBIT in particular continues to grow exponentially, adding another 70M shares in October, thereby growing its market cap to $88.47B despite a 4% contraction in BTC’s price. Moreover, IBIT has increased its market share to greater than 60% for the first time, taking share from all other ETFs except BTCO and EZBC, which each added a fraction to their respective market share (0.01%). In short, ETF growth continues, which is a great long-term sign for BTC-price bulls (i.e., not BTC maxis per se, as many OGs are seemingly exiting the market as BTC becomes more and more “institutionalized”).

Conclusion

October PA did not unfold as many had anticipated, though as illustrated above, I personally should have foreseen the impending contraction. Alas, Uptober is no more. Perhaps we should change it to “F@$ktober.” Perhaps not. Either way, I think the most interesting part of the cycle is about to begin. i.e., Is this time actually different or does the rhythm of the four-year cycle still hold? While I cannot say for sure at this point, what IS absolutely certain is that there is ZERO evidence thus far that the cycle has broken down. Might it still? Of course. But it hasn’t yet. And if it indeed has broken down, if the halving-cycle indeed no longer matters (or more correctly stated, no longer influences/predetermines BTC PA), then we should see bullish PA in November and/or December, with yet another new ATH being achieved. Moreover, Q1 2026 should also be bullish on the way to an overall bullish year. IF indeed this time is different, IF indeed the four-year cycle has broken down. But it hasn’t yet. And because it hasn’t broken down yet, because this cycle has thus far unfolded EXACTLY like each previous cycle, I personally have chosen to hedge my bets. Yes, I remain a BTC permabull. Yes, I foresee a $1M BTC eventually, though I have no idea when. But I am also a retiree who lives off my nest egg, so no, no matter how much of a BTC maxi I am in spirit, I cannot afford like Michael Saylor to never sell any BTC. Instead, I remain at least 50% invested at all times, and I trade major market trends with the other 50% of my capital, so that I can continue funding my way of life (including funding the lives of two youngs boys). In this way, I can continue to ride the elevator higher but also take greater advantage of any swoons along the way. What you choose to do with your money is of course up to you. The words above merely describe how I choose to invest given my circumstances, tolerance for risk and philosophical ideals.

See you in a month. In the meantime…

Go #BTC.

Thanks Dave!!