Disclaimer

The data I use (BitInfoCharts, Coinglass, CoinMarketCap) to compile the tables and graphs contained in the on-chain section of this analysis do not always align with data found via others sources like Glassnode and CryptoQuant. I cannot explain the reason for the differences nor can I confirm which sources are most accurate. For this and other reasons, I have come to trust only the on-chain data I collect when trying to explain and/or predict Bitcoin’s (BTC) future price action (PA). Whether you too find my on-chain analysis useful is for you to decide, but I can assure you some of my observations and/or predictions will differ, often markedly, from other observations and/or predictions you will see on Crypto Twitter (CT) and elsewhere.

Price Action

Open (on BLX): $107,171

High (on July 14): $123,084

Low (on July 25): $105,207

Close: $115,778 (+8.01%)

Tables

Calendar-Month Returns

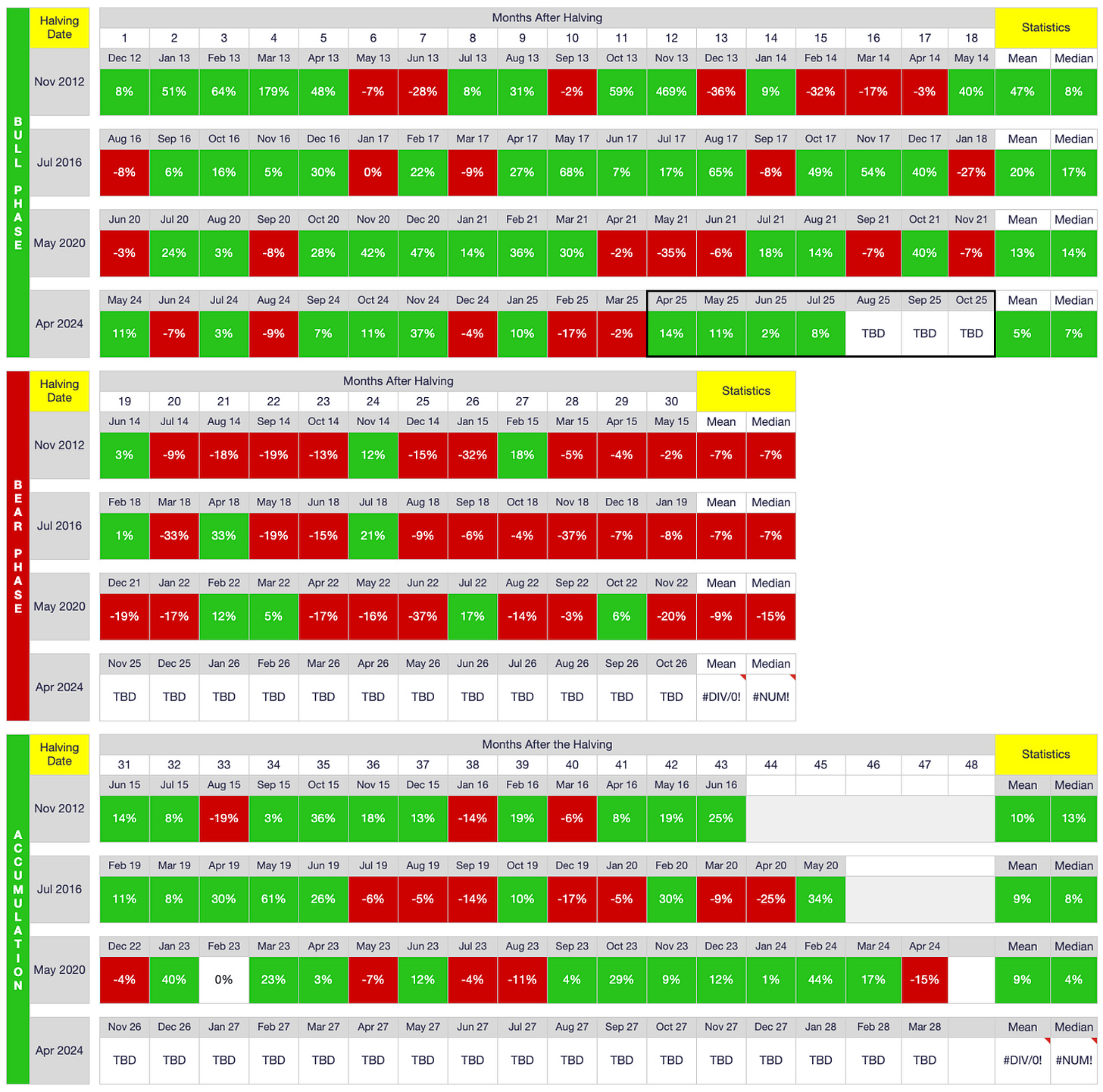

Halving-Cycle Returns

TL;DR: As anticipated, July 2025 was another up month for BTC, closing 8% higher despite weak PA the final half of the month. As shown above, July marks the fourth consecutive up month for BTC, a common trend during the bull phase of each cycle. That said, five (or more) consecutive up months is rare, occurring only once each of the previous three cycles (Dec 2012 - April 2013, April 2017 - August 2017, and October 2020 - March 2021). As such, while it wouldn’t be surprising if BTC closes higher in August, neither would it be surprising if PA finally took a breather. Given the malaise that typically affects many assets markets in August and September of each year, my guess is that either August or September will be a down month for BTC, but not both. i.e., Either August or September will likely close higher, but net-net, I think price at the end of September will be very similar to today’s price ($115-$120K). I then expect October to be a very strong month for BTC after two months of chop. The more interesting PA, in my opinion, is what occurs post-October, when the traditional end of the bull phase occurs. More on that in a few months.

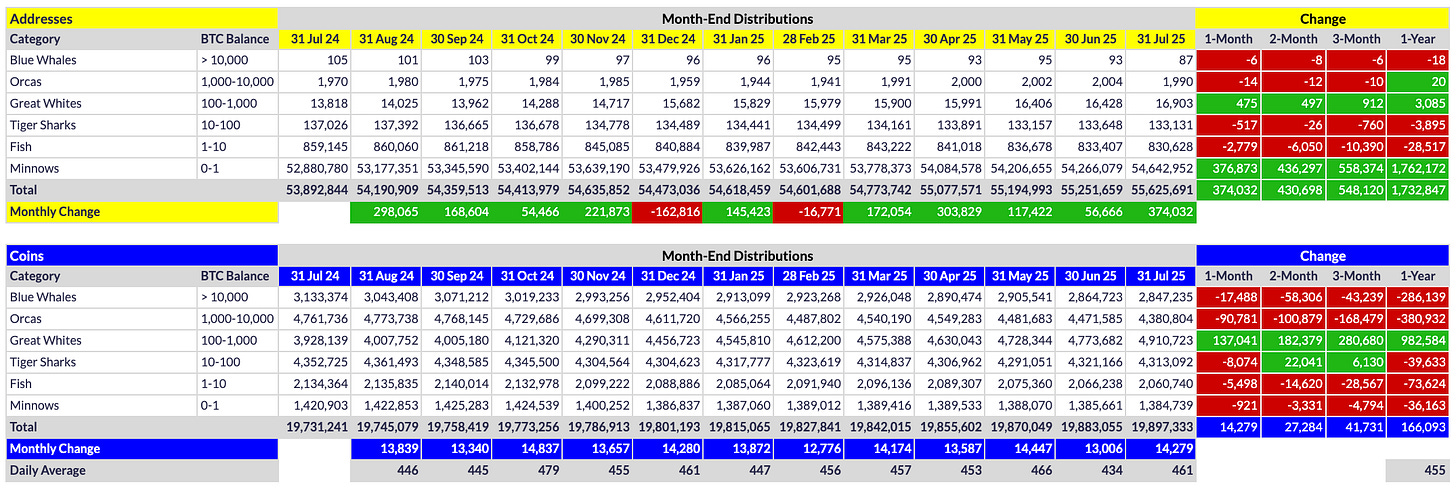

Address and Coin Distributions

TL;DR: Whales devolved in an unprecedented manner in July. Their projectile-vomiting of a combined 108.2K coins is breathtaking. While I have seen many champion the merits of this devolution relative to PA, these same pollyannas must also acknowledge that it will take an equally unprecedented amount of whale buying at some point if we are ever to experience a so-called god candle. The optimist in me believes we will see at least one more epic bull run at some point, but make no mistake, such a facemelting spike will require MASSIVE institutional and/or sovereign buying to induce. I personally don’t think we’ll see such buying this year/cycle, but I do nevertheless think we’ll see a nice bump in price come October.

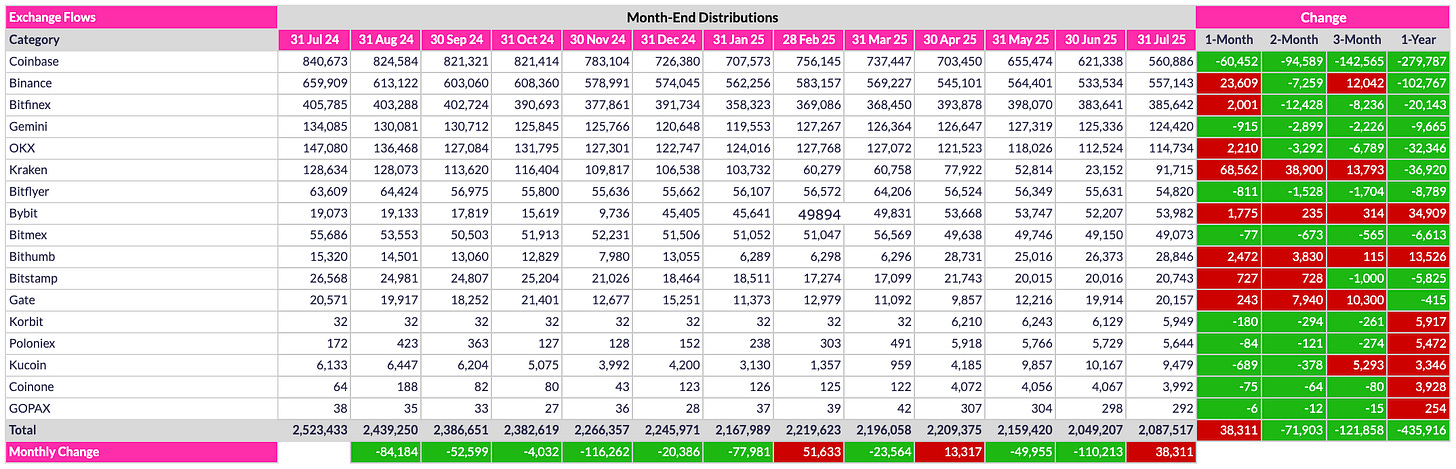

Exchange Flows

TL;DR: Exchange inflows in July reflect the whale dump that occurred. July in fact marks the first net inflow since April and the second largest inflow of the past 12 months (second only to February). One particularly interesting change in flows is the 60.5K outflow from Coinbase that coincided with the 68.5K inflow into Kraken. Have some US whales decided Kraken is preferable to Coinbase? Can’t say for sure, but it certainly looks like it.

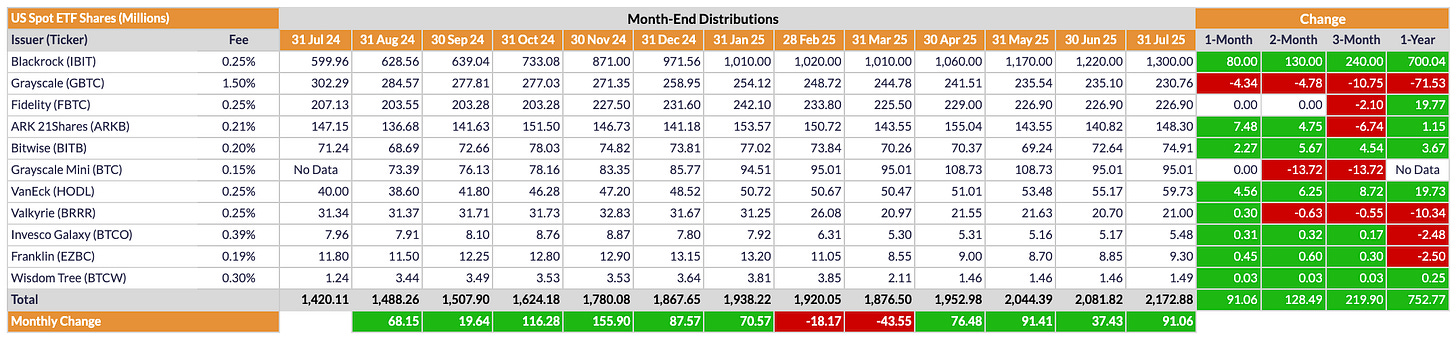

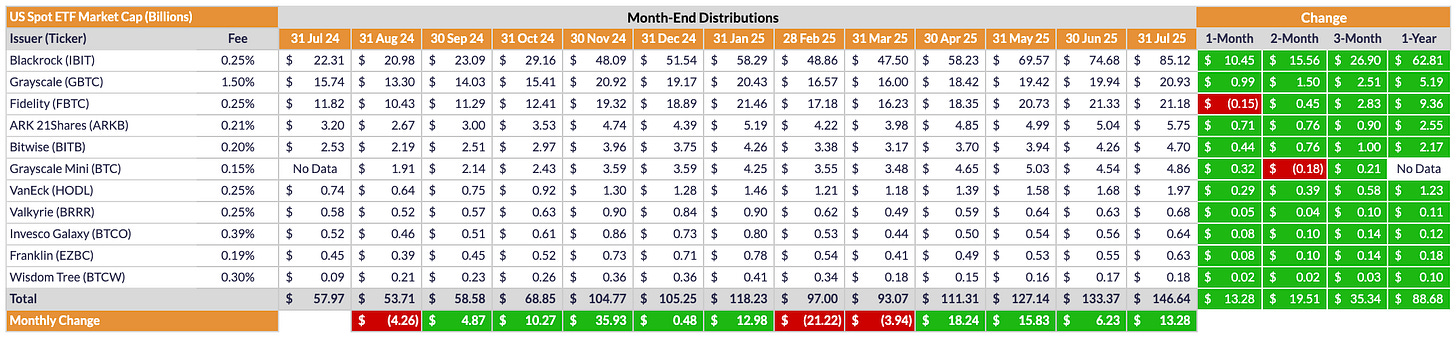

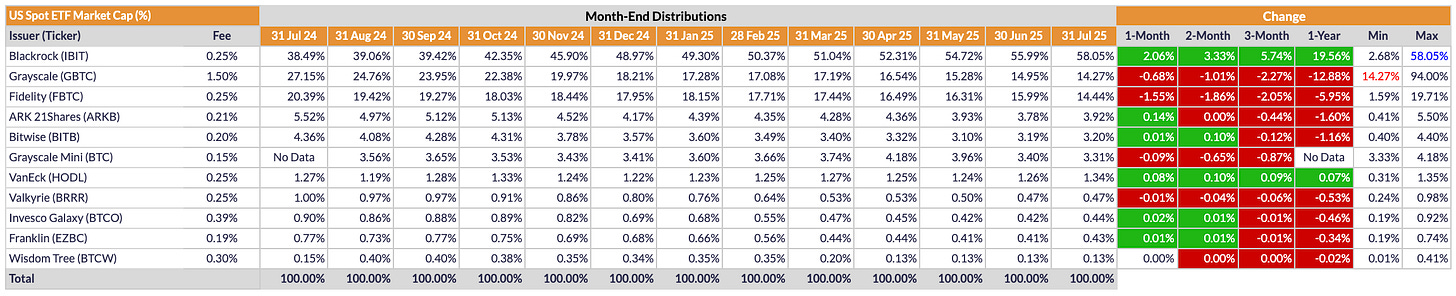

US spot-BTC Exchange Traded Funds (ETFs)

TL;DR: As is the new norm, Blackrock’s US spot-BTC ETF (IBIT) continues growing by leaps and bounds, often at the expense of other ETFs (most notably GBTC). That said, several other ETFs did expand their share of the market in July, including ARK 21 Shares (ARKB), Bitwise (BITB), VanEck (HODL), Invesco Galaxy (BTCO) and Franklin (EZBC). Overall, nearly every ETF (sans FBTC) increased its market cap in July, due of course to the 8% increase in BTC’s price.

Conclusion

July 2025 was another great month for BTC price-wise (despite the whale dump), increasing for the fourth consecutive month and adding 8% to its price. That said, I understand why some are feeling less sanguine, given that BTC reached a new all-time high (ATH) of $123K on July 14, only to spend the second half of the month dropping nearly $8K, including $4.5K the final four days. Still, 8% higher is 8% higher, so I encourage everyone to maintain a birds-eye view of the market. BTC is extremely strong right now and has been for most of the past two years (price has risen a staggering $90K / 350% the past 22 months - from $25K in September 2023 to $115K now). As such, we bulls hardly have anything to lament. That said, I have a feeling the next two months will be choppy, so anxiety will undoubtedly increase from here. Still, for those who can see the forest for the trees, there is good reason to remain hopeful. This cycle has been unfolding EXACTLY like previous cycles, so if it continues doing so, October will be a great month indeed. What happens after that is another matter, of course, but first things first.

Hope everyone is well, and of course…

Go #BTC.

excellent work as always David!