Month-End Data (Limited Analysis)

June 2025

Disclaimer

The data I use (BitInfoCharts, Coinglass, CoinMarketCap) to compile the tables and graphs contained in the on-chain section of this analysis do not always align with data found via others sources like Glassnode and CryptoQuant. I cannot explain the reason for the differences nor can I confirm which sources are most accurate. For this and other reasons, I have come to trust only the on-chain data I collect when trying to explain and/or predict Bitcoin’s (BTC) future price action (PA). Whether you too find my on-chain analysis useful is for you to decide, but I can assure you some of my observations and/or predictions will differ, often markedly, from other observations and/or predictions you will see on Crypto Twitter (CT) and elsewhere.

Price Action

Open (on BLX): $104,650

High (on June 9): $110,437

Low (on June 22): $98,350

Close: $107,194 (+2.43%)

Tables

Calendar-Month Returns

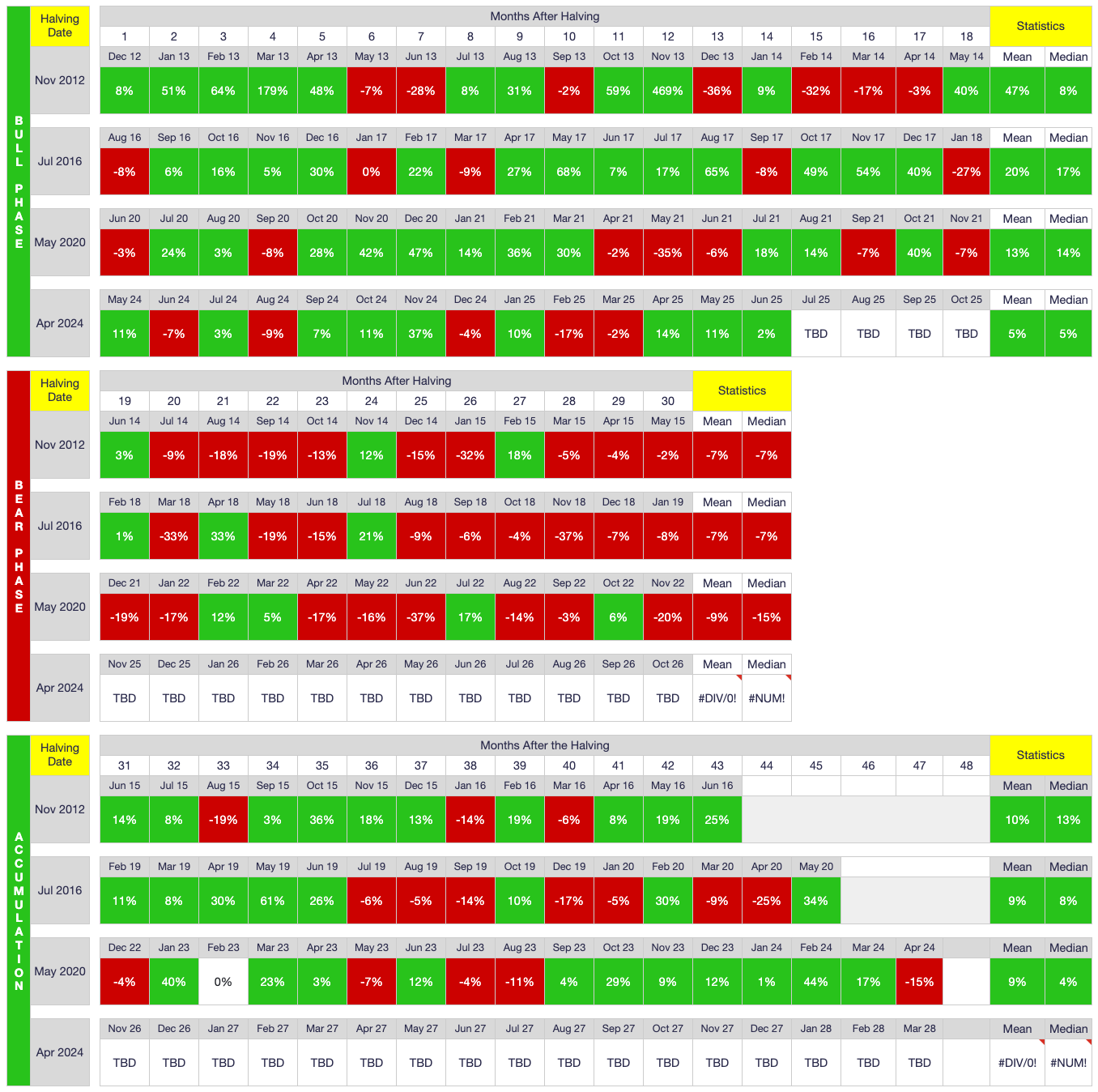

Halving-Cycle Returns

TL;DR: As anticipated, June 2025 was another up month for BTC, albeit only modestly so. As shown above in the halving-cycle table, only four months remain in the bull phase of this halving cycle. i.e., Whether the rhythm of the halving cycle still matters will soon be put to the test.

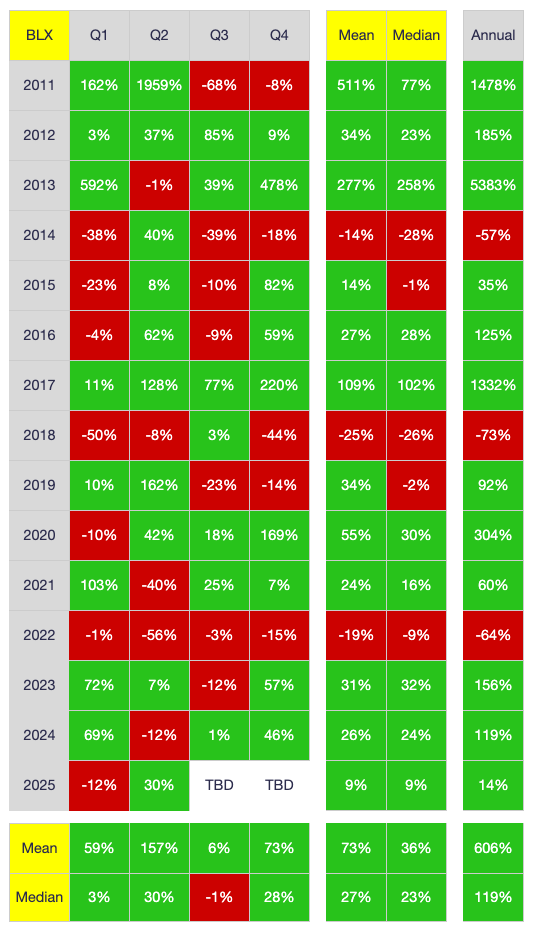

Quarterly Returns

TL;DR: Q2 was a strong bounceback (+30%) after the weak performance of Q1 (-12%). BTC’s annual return now stands at 14% YTD and I expect Q3 to be the strongest quarter of the year given its position in the halving cycle and despite the fact Q3 is typically the weakest quarter of the year from a calendar-year perspective.

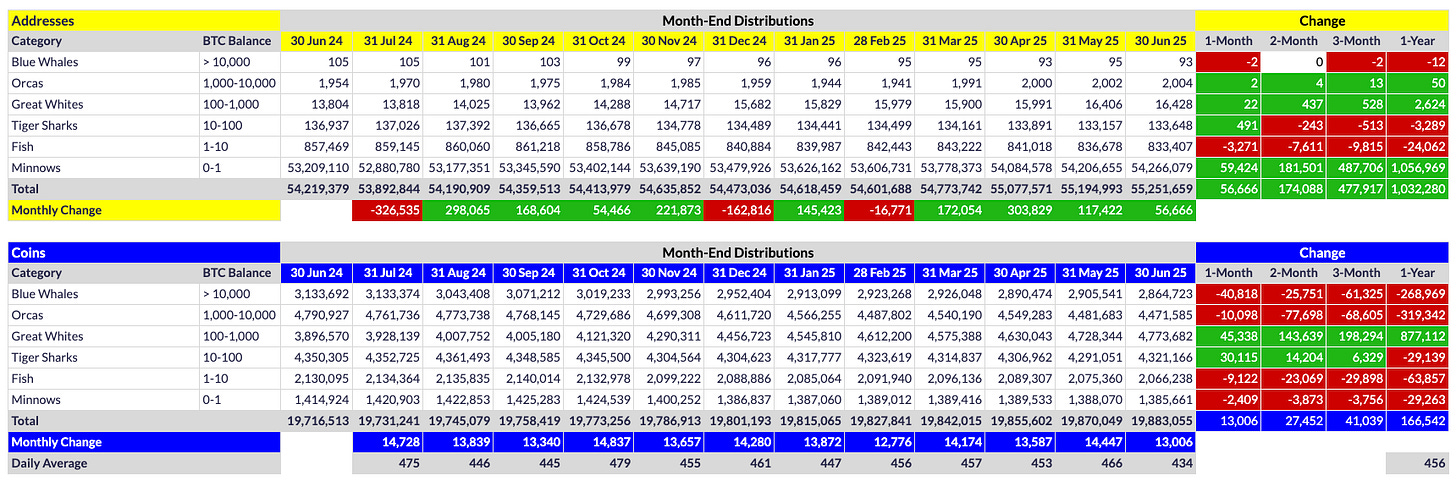

Address and Coin Distributions

TL;DR: The two devolved Blue Whales in June were exchange wallets, so that is actually net positive as shown below in the exchange flows table. However, non-exchange Orcas were also modest net sellers, which thwarted any attempted rallies during the month. Overall, coins consolidated among the sharks as retail investors were net sellers as well despite some growth in retail addresses.

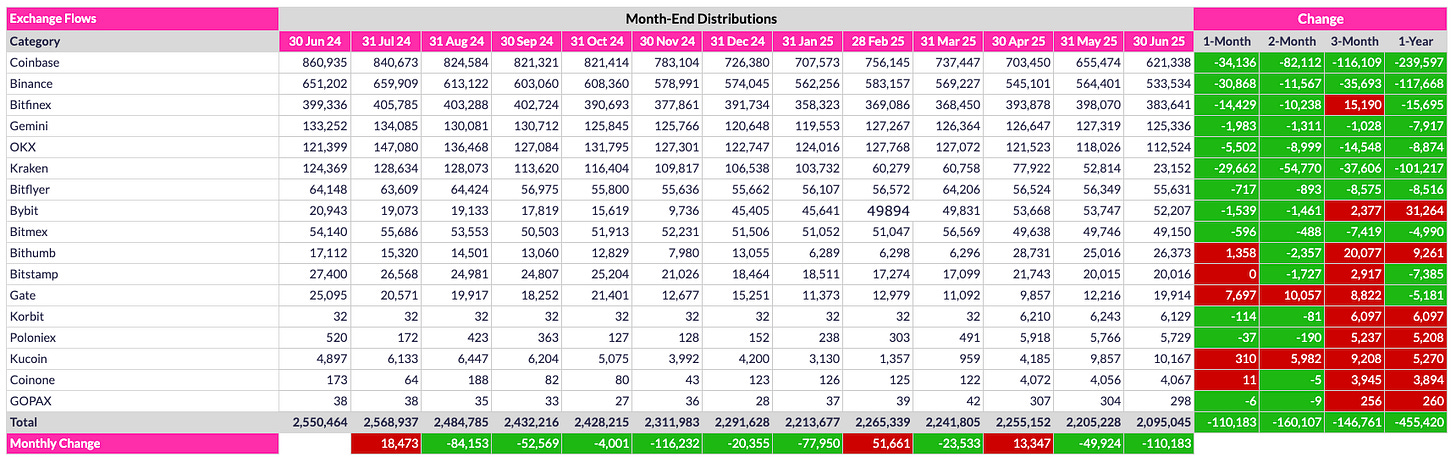

Exchange Flows

TL;DR: If Coinglass data are to be trusted (debatable), a truckload of coins left exchanges in June (110.2K), the most since November 2024. Moreover, the aggregate exchange balance is now at its lowest ever, the latest evidence yet large institutional buyers now dominate the market (for better or worse).

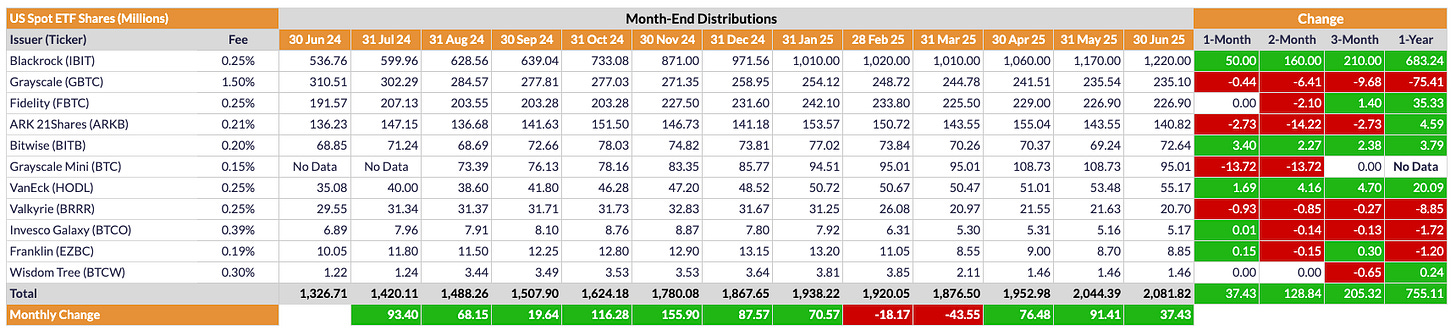

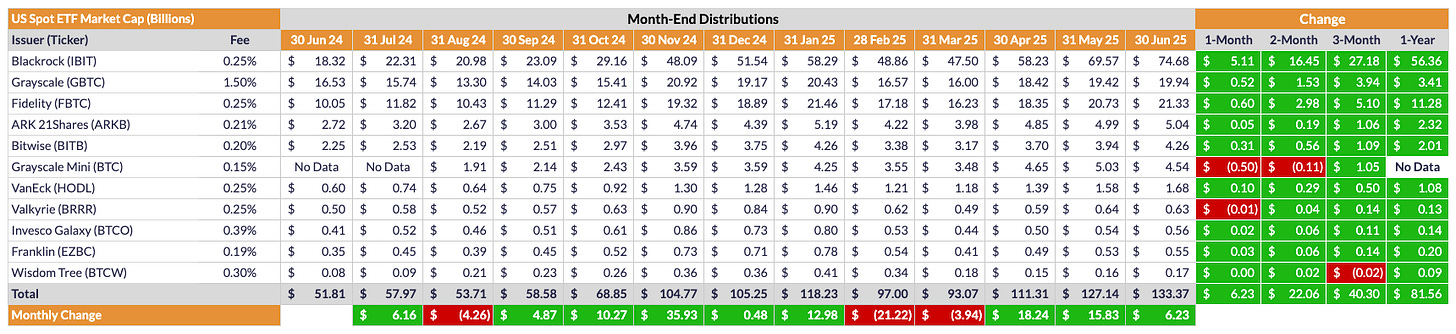

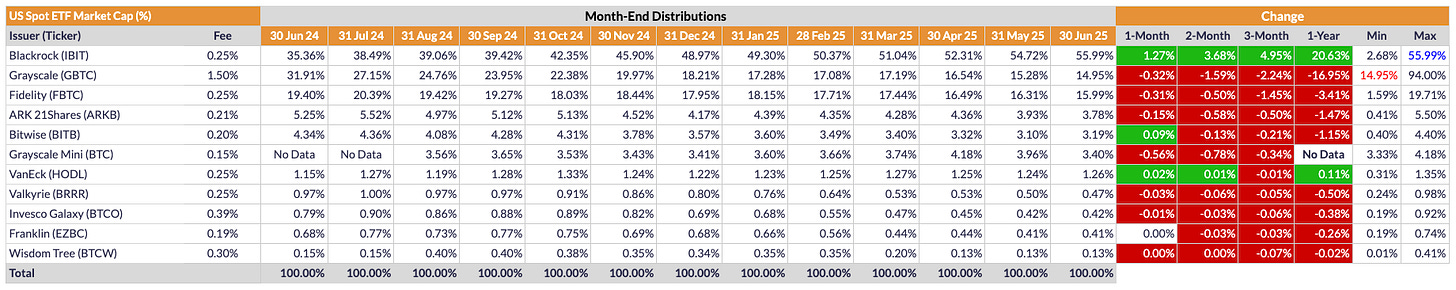

US spot-BTC Exchange Traded Funds (ETFs)

TL;DR: IBIT remains king of the jungle. It is essentially the only US spot-BTC ETF consistently growing month over month, and much of that growth is coming at the expense of the other ETFs. IBIT now controls 56% of the US spot-BTC ETF market, its largest share to date.

Conclusion

As anticipated, June was another up month for BTC, albeit only modestly so. There were a couple of attempted rallies during the month, but as I explained on Twitter, the rallies lacked strength, so it is unsurprising they failed. The next few months should be more interesting PA-wise, however, as Q3 is typically the weakest quarter of the year, but we are also entering the final stage of this cycle’s bull market. As such, Q3 should be a particularly strong quarter PA-wise, at least to the extent halvings still matter. i.e., The next three months will be the best test yet whether the rhythm of the halving cycles still hold sway over PA. I for one believe they do. Here’s to hoping I am correct.

Go #BTC.