The Widespread Misunderstanding of Grayscale Growth

Introduction

Crypto Twitter (CT) is rife with tweets about the seemingly outsized growth that Grayscale Trust is experiencing. The associated excitement is understandable because Grayscale’s growth is seen as a bellwether for the tsunami of institutional investment seemingly storming toward crypto shores. However, many folks seem to misinterpret the increases we keep seeing in Grayscale’s assets under management (AUM), and sadly, Barry Silbert and team are doing nothing to discourage this misinterpretation, putatively because it is great advertising for Grayscale, misleading as it is.

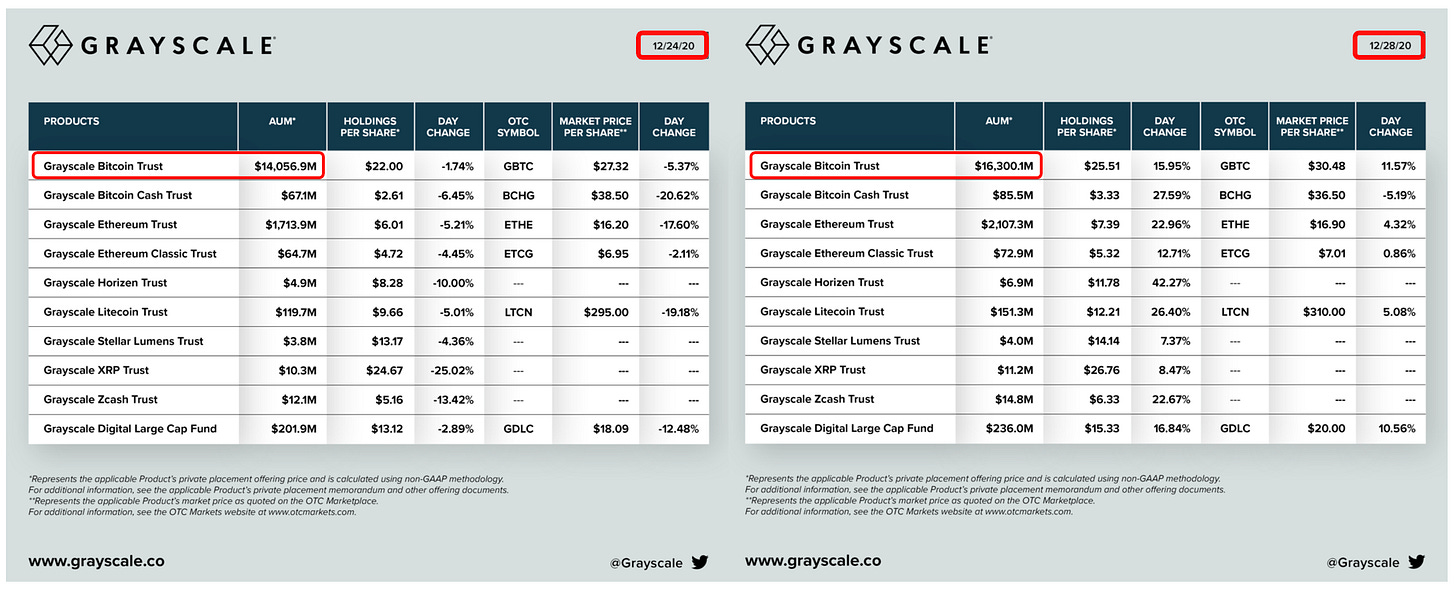

Following is a delineation of the misinterpretation using the three most recent AUM charts tweeted by Grayscale, focusing solely on GBTC, but with the understanding that this analysis is applicable to all of their funds across any timeframe.

Analysis

The fundamental problem with the AUM charts that Grayscale distributes is that they fail to disambiguate fund inflows from asset appreciation. In other words, growth in assets under management (AUM) bundles fund inflows with asset appreciation, so it is impossible to determine from the charts how much AUM growth is due to new investors piling in verus increases in asset price. Let me illustrate.

Note in the chart comparison above that Grayscale’s Bitcoin Trust (GBTC) had AUM of $14.06B on December 24 and $16.30B on December 28, which is an increase of $2.24B. At first glance, these data seem to suggest that Grayscale’s investors, widely believed to be institutions and high-net-worth individuals, plowed $2.24B of fresh capital into GBTC over the holiday weekend. If this were actually the case, it of course would be enormously bullish. Alas, all is not what it seems.

See the daily price chart of BTC below:

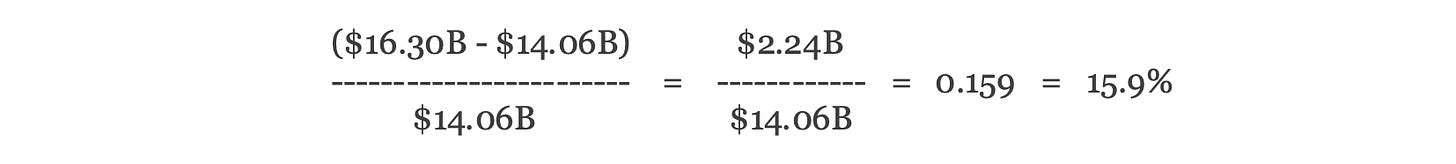

As shown, BTC’s price increased 14.1% over the same four-day period (Dec 24-28), climbing from $23.7K to $27.1K. With that in mind, what percentage increase did GBTC’s AUM experience over the same time period? Let’s calculate it:

As shown, GBTC’s AUM increased 15.9% over the four-day holiday weekend period, but BTC’s price increased 14.1% over the same time period, meaning GBTC’s new inflows account for only 1.8% of the AUM increase (15.9% - 14.1% = 1.8%, or $40M). Point in fact, the actual amount of inflows may be a bit more or less depending on when Grayscale created these charts on December 24 and 28, respectively, as well as what data sources they use. In other words, it’s possible that GBTC had ZERO net inflows over this period, which is actually plausible given that it trades only during US market hours, so its inflows were presumably unchanged between the evening of December 24 and the morning of December 28.

It is worthwhile to illustrate the opposite scenario as well before concluding this analysis - the case where GBTC experiences outflows and/or AUM contraction.

See below the change in AUM between yesterday (Dec 28) and today (Dec 29). This comparison illustrates net outflows from GBTC, where GBTC experienced a contraction rather than growth in investor capital.

As shown, GBTC AUM shrunk from $16.30B yesterday to $16.16B today, implying an outflow of $140M (0.8%). Note, however, that BTC’s price increased 1.2% today, so GBTC’s actual outflows were 2.0% of AUM (0.8 + 1.2 = 2.0, or $326M). In other words, GBTC investors cashed out $326M worth of GBTC today, but because GBTC appreciated about $186M, GBTC’s net AUM contraction was “only” about $140M (NB: There is no real reason this investor outflow should raise concern among BTC bulls; my understanding is that it is a function of the window Grayscale provides its investors to enter/exit GBTC and its other funds. In this case, the exit window just opened, so some investors cashed out. Foolishly, IMO, but to each his/her own).

Discussion

The reason it is important to differentiate investor inflows and asset appreciation is because BTC (and other asset prices) have skyrocketed in 2020. Therefore, while Grayscale has undoubtedly seen a lot of new investors pile into GBTC throughout the year, net investment inflows are demonstrably smaller than the AUM increases we repeatedly see. As such, if investors want to know the true growth of GBTC inflows, they either need to first subtract asset appreciation from the reported AUM or look to other sources of Grayscale data. Thankfully, Grayscale publishes other charts that provide a much clearer indication of actual GBTC demand. Below is one example.

As shown, Grayscale has undoubtedly experienced tremendous investor growth over the years, independent of the price appreciation of its assets. But to the extent that investors are trying to ascertain greater institutional demand for, e.g., BTC, by monitoring GBTC growth, it is important they look to at these alternate sources of data and NOT assets under management per se.

There is of course a simple solution to this problem. Grayscale could simply add a column to their AUM charts illustrating either how many coins are held in each trust or their net inflows/outflows for each asset. Adding either/both of these columns would immediately resolve the widespread misinterpretation running amok with respect to fund growth based on increases in AUM. Then again, what looks more impressive? An increase of 15.9% or 1.8%?

Conclusion

I love Grayscale because it is quite literally the only option currently available for a wide range of US investors. It also serves as a “gateway drug” for some investors who want to invest in crypto but are wary of trying to buy it on exchanges and then having to figure out how to custody it. GBTC can also be traded in a Roth IRA, which has tremendous tax advantages. In short, other than gaining indirect BTC exposure via MicroStrategy (MSTR) stock, GBTC is one of the only options many would-be BTC investors have until, e.g., a BTC Exchange Traded Fund (ETF) eventually gets approved by the Securities and Exchange Commission (SEC).

Bless Barry and the team as well for their tireless promotion of the Grayscale family of funds, including prime-time TV commercials and a near-constant presence on Twitter and other social media. In short, we crypto bulls owe a lot to Grayscale for crypto’s growing familiarity among the wider investment community. However, I do think they mislead their audience by not including columns for coin holdings and/or net inflows/outflows in their widely disseminated AUM charts.

C’mon, Barry et al: please don’t leave it up to your audience to try to differentiate investment inflows/outflows from asset appreciation/depreciation. It is at best tedious and at worst dishonest. While you obviously are not directly responsible for any misinterpretations of the data you publish, you and the team should promote greater transparency in the AUM charts in particular, given how widely they are circulated on CT, podcasts, and elsewhere.

Here’s to hoping for such changes. In the meantime, thanks to Barry and the Grayscale team for all that they otherwise do for our rapidly growing crypto community.