Introduction

I have been collecting Bitcoin (BTC) on-chain data from three sources for the better part of the past 11 months. Specifically, I have been collecting data on changes to the number of active addresses and coins held by each major tier of investor (bitinfo), coin flows on exchanges (bybt) and daily trading volume (coinmarketcap).

I decided to track address and coin data because I believe the following to be true:

Changes in the number of active addresses is a proxy for network adoption: increasing addresses = growing network adoption; decreasing addresses = shrinking network adoption. i.e., We can track the strength of BTC’s network effect by monitoring changes to active addresses.

Changes in the number of coins held by each investor group is a proxy for market sentiment within a group: increasing coin count within a group = bullish sentiment; decreasing coin count = bearish sentiment (NB: coin distributions across groups are more complex than this of course because the number of coins is finite, so, e.g., all groups could be bullish simultaneously yet one or more groups could still experience a net reduction in coins. More on this later.)

To head off the “Yes, but…” comments I imagine brewing, let me say the following:

I know some addresses hold coins for many people, what I call “aggregator addresses.” I also know some individual investors spread their stacks across multiple addresses for privacy and/or security reasons. I also know some wallets are exchange wallets. I also know my data sets are not complete (although I would argue they all function as excellent if unintentional stratified random samples). I am very aware of all of these caveats and others. But I would also argue that these caveats do not matter from a macro perspective. As I’ll demonstrate later, price action (PA) over the past 11 months reinforces my belief that we only really need to track macro-level changes in address and coin data to understand where BTC price is headed (or more precisely, that individual/micro-level changes do not correlate well with BTC’s PA). In other words, keeping it simple is usually the optimum approach and the data I collect reinforce this belief. It also happens to be the reason I personally have ceased following more detailed on-chain data sources and the analyses based on them. Keep it simple, sunshine. Doing so works, as I’ll demonstrate.

I decided to track exchange flows because I believe the following to be true:

Coins are typically moved off exchanges to minimize counterparty risk (“not your keys, not your coins”).

The larger the investor, the more likely their purchase is to be moved off an exchange.

Coins that are moved off exchanges are less liquid (less likely to be traded) than coins on exchanges.

The fewer the number of coins on exchanges, the less liquidity there is for new buyers.

If all of the above are true, then: exchange outflows = increased hodling = less liquidity for new buyers = higher price; exchange inflows = decreased hodling = more liquidity for new buyers = lower price. Supply and demand 101.

I decided to track daily trading volume because I believe the following to be true:

Any market’s price is a reflection of trading at the fringes, meaning the vast majority of an asset’s supply is dormant most of the time. This is particularly true for BTC. i.e., The amount of BTC that is available for trading at any given moment (known as “the float” in equity markets) is very small. For this reason, BTC’s price is very sensitive to the amount of BTC being traded.

Because BTC’s price is so sensitive to the volume traded, the higher the volume traded, the more sustainable the price trend (which is true in both directions, unfortunately). i.e., If price increases or decreases substantially on low volume, it can also be reversed quite easily. This is less true when trading volumes are high.

My Hypothesis

Based on the data I track and the beliefs I hold regarding changes in these data, I have for a long time believed the following to be true:

Changes in price are more substantial, more sustainable and more predictable when based on changes in whale participation rather than retail participation.

This is NOT to say I think retail participation is unimportant. Clearly it is, especially over the long term for those among us who believe Bitcoin will one day be a (the?) world reserve currency. However, what the data clearly show is that PA is far less stable when the market is dominated by retail participation compared to when it is dominated by whale participation (NB: After analyzing these data over the past several months, I have come to believe the middle tiers - the sharks, in my taxonomy - are mostly institutional traders, whereas most whales and fish/minnows are would-be hodlers, some of whom unfortunately become unwilling traders as they jump into and out of the market due to BTC’s legendary volatility).

There is a straightforward reason for my hypothesis above: purchasing power. As I explained in this article, at these BTC prices (mid-five-figure USD), only whales can purchase BTC in any meaningful volume. By way of example, consider the sample distro chart below, which I update daily on my Twitter feed:

As shown in the “BTC per Address” column, the average Orca address holds 2,551 BTC whereas the average Minnow address holds 0.03 BTC. In other words, the average Orca has the purchasing power of 85,000 Minnows. 1:85,000. This is the reason - the magnitude of a whale’s purchasing power - that BTC price moves are more substantial, sustainable and predictable when whales are the dominant market participants. Put another way, their accumulation and distribution patterns directly influence trading volume. i.e., When more whales are active, the more volume that is traded and the more sustainable the prevailing price trend is, whether up or down.

Again, this has been my hypothesis for a long time, and frankly, it is not particularly insightful. Regardless, I lacked sufficient data to test it - at least before now. More accurately, I have been collecting screencaptures of address data since October 20, 2020, but until yesterday, I never took the time to input them into a spreadsheet so that they could be analyzed. I have now done so. My analysis is below.

Analysis

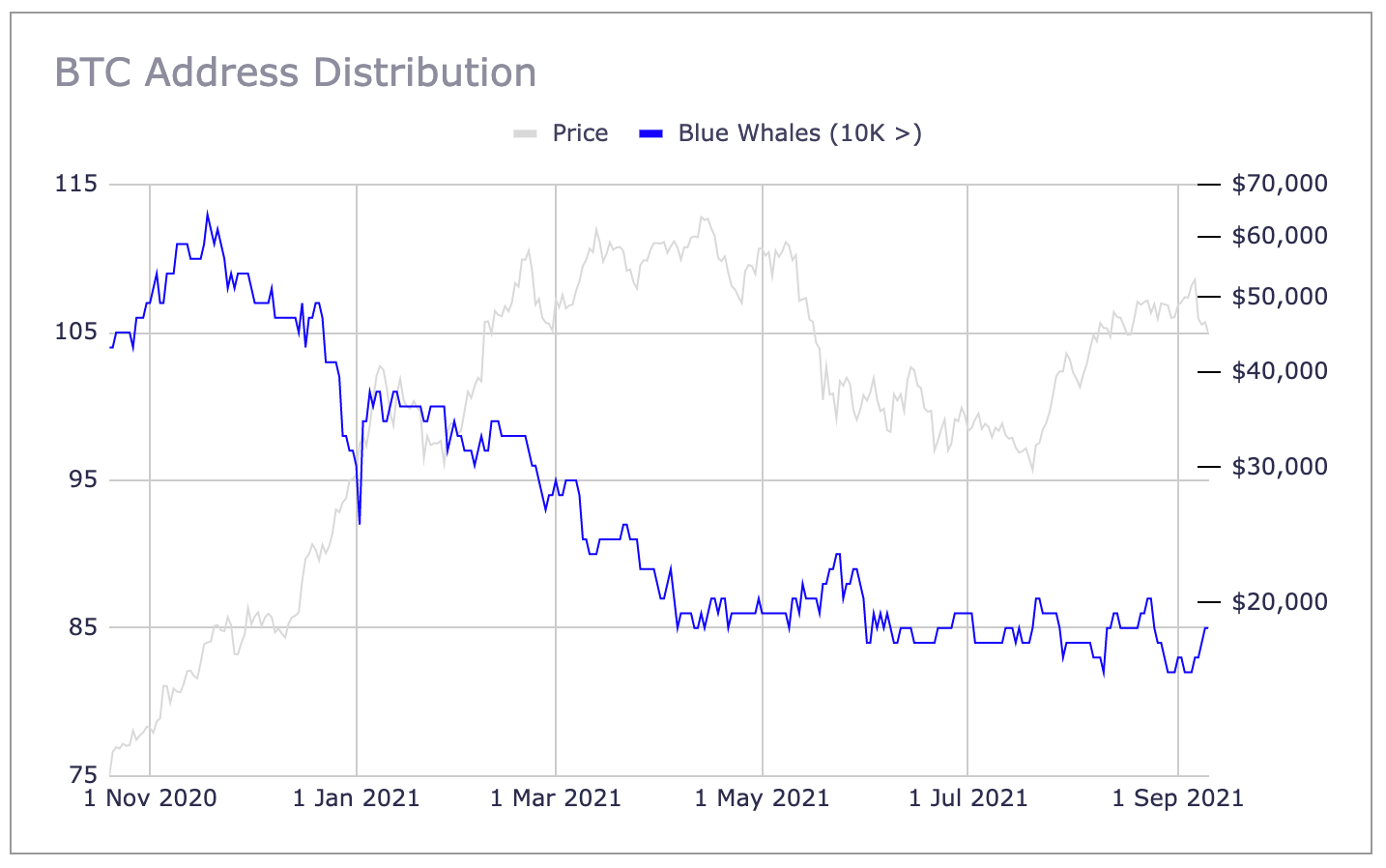

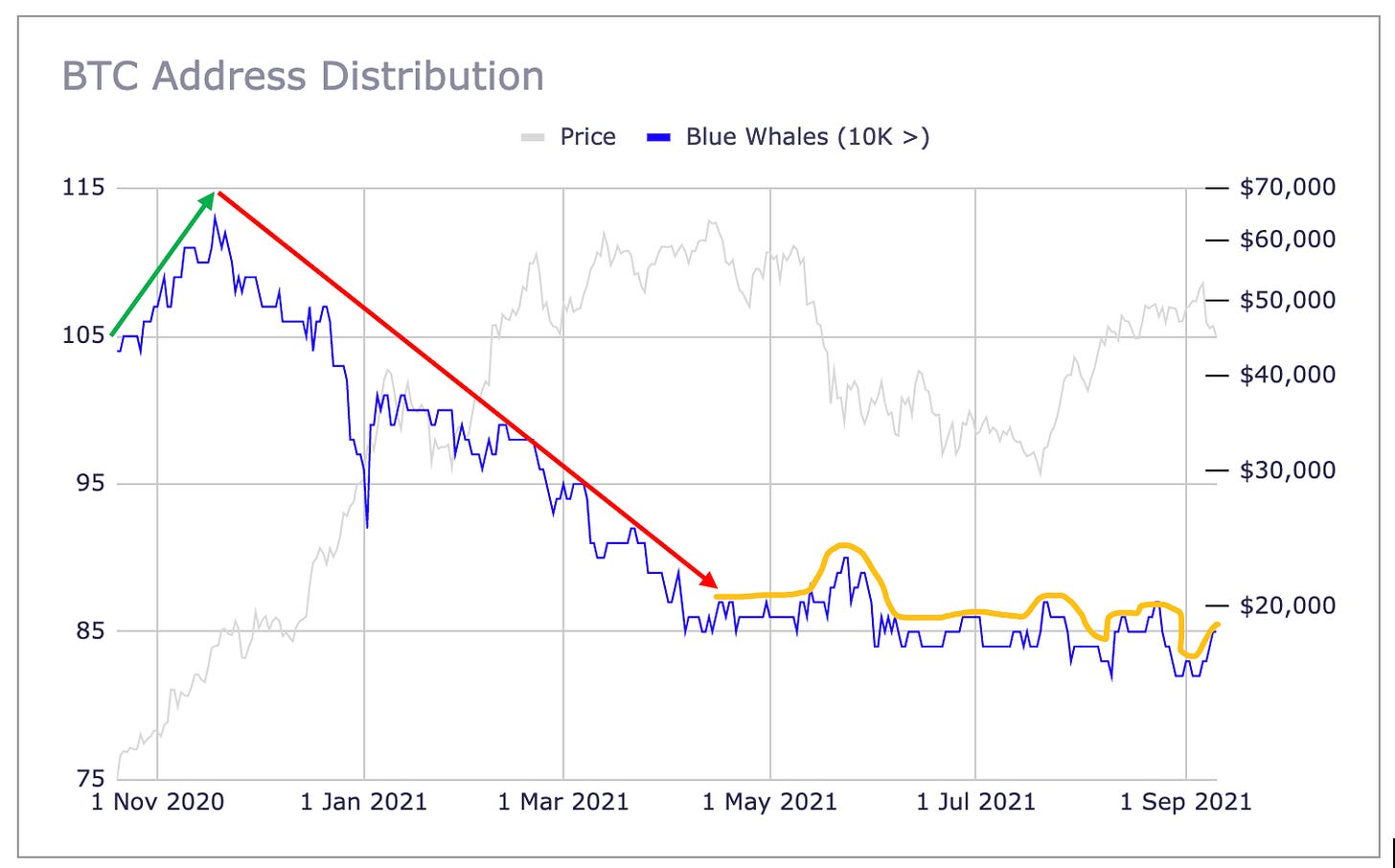

As I tweeted yesterday, most of the price action we have seen since at least last October is explainable, and therefore predictable, based primarily on changes in whale participation. For example, look at the changes in active Blue Whale (BW) addresses since October 20, 2020, compared to the commensurate price action.

As shown below, the number of active whale addresses steadily increased into mid-November, peaking on November 18 (at 113), before beginning a steady descent all the way to April 6, when the number of active BW addresses reached 85, the same number it is today (September 11). i.e., BW addresses have stabilized since April 6, vacillating between 82 and 90 since then, averaging 85.3 over the past five months.

When examining changes in BW addresses more closely, what becomes apparent quite quickly is that an increasing number of BWs reliably precedes a sustainable runup in price, meaning changes in the number of active BW addresses can serve as a reliable indicator of future price. As shown below, the steady increase in BW addresses into mid-November preceded a steady increase in price all the way into the first week of January (NB: Unfortunately, I didn’t start recording detailed address data until October 20, but I do know the number of BWs had been increasing steadily since at least September based on my visual inspection of the data prior to October 20).

What happened next - the correction that began on January 9 and lasted most of the rest of January - was also predictable, as shown below:

As shown, the steady decline in BW addresses that began November 19, combined with the added gut punch of a number of BWs suddenly closing out their positions for the week-long Christmas-New Year holiday break, preceded the price correction that began January 9 and lasted most of the rest of the month. i.e., I would argue that the January swoon was entirely predictable due to the sudden reversal in the number of BWs participating in the market, just as the price climb before the correction was predictable based on the increasing number of BWs prior to the runup. The challenge of course is knowing precisely when a price reversal will occur. It is impossible to predict such timing with complete accuracy, but in this case at least, PA lagged BW changes by about seven weeks.

Moving down one investor tier to the Orcas (1K-10K coins) presents an even more compelling picture of the correlation between changes in whale addresses and PA. Below is a graph of the changes in Orca addresses since October 20, 2020, compared to the commensurate price action.

As shown below, the pattern of Orca behavior very well predicts subsequent PA, and even more proximately than changes in BW addresses. i.e., As with the BWs, the number of Orcas had been steadily increasing for several weeks prior to October 20, which explains the price increase in November. However, unlike BWs, Orcas kept increasing in number all the way until December 24, when the pod experienced a brief but steep drop in number (for the holiday closeout), before resuming their upward trend after January 1, all the way to February 7, where they peaked at 2392.

These three Orca trends - up, down briefly but steeply, back up steeply - all foretold subsequent PA, which followed exactly the same pattern. However, rather than preceding PA by seven weeks, as with the BWs, Orca trends preceded PA by 2-3 weeks.

While PA was eerily predictable based on changes in both BW and Orca addresses into at least February 2021, these correlations seemingly broke down from March. Upon deeper examination, however, subsequent PA in 2021 can in fact be explained by changes in whale addresses, at least in part.

Below are the two graphs highlighting changes in BW and Orca addresses, respectively, compared to the commensurate PA since February 2021.

One thing that stands out immediately is that both BW and Orca addresses had been declining for a long time before price reached its current all-time high (ATH) on April 13. Moreover, price has whipsawed throughout much of 2021 despite a steady decline in whales over the same period. The question then is how can I claim causation between whale counts and PA? The answer is simple: the absence of (or decrease in) whales since February has destabilized PA, making it much more susceptible to both retail sentiment and any relatively large buy or sell orders. Look above, for example, at the steep decline in Orca numbers from their peak on February 7 (2392) to the point at which they temporarily stabilized (beginning of April, at 2150). What was price doing during this time period? Ebbing and flowing, repeatedly putting in new ATHs, but also losing momentum, with each incremental new ATH less robust than the previous ATH. In other words, Orcas continually sold into this extended price momentum, momentum that had its roots in retail FOMO, as shown below:

As shown, and as stated throughout, whales have been in steady decline since early 2021. On the other hand, retail investors, and Minnows in particular, steadily increased in number all the way through April 30 before reversing course in May due to the steep correction that began May 12. In other words, retail momentum was able to extend the prevailing price trend established by whales during Q4 2020 and early Q1 2021 for several months, but inevitably the steady exodus of whales throughout 2021 meant that price was becoming less stable and less sustainable with each passing day.

The next question then is whether PA can be predicted when retail participation is dominating the market rather than whale participation. Generally speaking, no.

Put differently, retail sentiment exerts outsized influence on PA when whale participation is lower, so yes, to some degree, one could theoretically profitably trade during a retail-dominated market, but only to the extent that one can get in on bullish reversals early and exit on bearish reversals quickly. How practical is that? Not very, in my opinion, but before writing off trading in a retail-dominated market all together, consider the events that seem to have precipitated significant price reversals during the retail-dominated phase of 2021:

As shown above, and whether people choose to acknowledge this reality or not, @elonmusk comments have precipitated three of the four largest price moves of 2021, and arguably the only three moves that led to sustained price reversals (as opposed to, e.g., the original El Salvador announcement, which led to a temporary price bump, but one that faded within days).

There is one caveat to the three Elon-related events. Note that the first price reversal, in early February, was both organic and sentiment-driven: organic in that $TSLA announced its purchased $1.5B of BTC on February 8; sentiment-driven in that Elon changed his Twitter profile to include Bitcoin around the same time. Interestingly, recall also that Orca addresses peaked on February 7, one day before the Tesla announcement. Coincidence?

The other two Elon-related events occurred much later - May 12 (Tesla stopped accepting BTC as payment) and July 21 (Elon participated in the B-word Conference with Jack Dorsey and Cathie Wood). The first event triggered the start of a 50%+ selloff; the second spurred the current rally that led price to once again eclipse $50K, at least until bad actors tried to sabotage El Salvador’s launch of BTC as legal tender.

Regardless, the primary conclusion is clear:

In the absence of many active whales, PA is much more susceptible to retail sentiment and is therefore inherently less stable/sustainable.

One other demon with which to contend during retail-dominated markets is lower trading volume, which not only makes BTC’s price more sensitive/less stable but also increases the impact of leveraged positions during sudden price reversals, especially during downtrends, as most retail investors open long positions when using leverage.

Recall also that volume is lower during retail-dominated phases of the market due to the relatively limited purchasing power of retail investors when compared to whales. Summer 2021 provides clear evidence of this. Not only did whale participation steadily decline throughout the summer, but institutional investors and traders, at least those in the US, typically curtail their activity during the summer months across all markets (“Sell in May and go away”). It is little wonder then that daily trading volumes were lower by 50%+ this summer compared to what they were during Q4 2020 and Q1 2021. It is for this reason that sudden price reversals, particularly to the downside, cause precipitous drops given that leveraged long positions get liquidated as well.

In sum, then, PA is more susceptible to changes in sentiment and temporary volume spikes when the market is retail-dominated rather than whale-dominated, primarily due to lower trading volumes, which has been the case over the past several months.

Conclusions

Synthesizing all of the previous findings leads to the following conclusions:

Changes in whale addresses fundamentally determine the size and/or sustainability of future BTC price moves.

Changes in BW addresses are an earlier indicator of future PA, leading PA by as much as seven weeks based on the limited data collected to date.

Changes in Orca addresses are also a leading indicator of future PA, but much more proximately, leading PA by 2-3 weeks.

Price-trend continuations following whale-trend reversals are due to retail momentum in the prevailing direction. For those old enough to relate: think Wile E. Coyote remaining temporarily suspended in mid-air after running off a cliff (for those who have no idea what I’m talking about, see here).

When few whales are active in the market, trading volumes markedly decrease.

Lower trading volumes make PA less stable and therefore less predictable due to shifts in retail sentiment and temporary volume spikes, both of which are typically unforeseeable. As a result, trading during retail-dominated phases of the market is precarious, in my opinion, unless trading on low time-frames (minutes, hours) or unless one is agile/alert enough to catch the many sudden momentum reversals that occur during retail-dominated phases of the market.

So, what’s next for Bitcoin’s price then?

For those who follow me on Twitter, you likely see my daily address and coin distribution updates. After having performed this analysis, I can assure you I am going to monitor MUCH more closely any changes in BW and Orca addresses here forward because I am now utterly convinced they foretell future PA. I simply have no doubt.

Note too that I have made no mention of coin distributions in this article, which one could argue are even more important than address changes. However, my paradigm with respect to address and coin distros has been forever changed by this analysis.

In brief, I have now come to believe that there is an existing whale base that comprises hardcore long-term BTC maximalists who will never sell, or least who will sell only small chunks during price spikes so they can raise capital to buy even more BTC later when price inevitably retraces. There is no better example of this type of whale than the single largest non-exchange wallet in existence:

As shown, this whale buys 8x as often as they sell (441 “ins” vs. 54 “outs”), so they are clearly a hodler as opposed to a trader. By tracking their coin flows the past several months, I have noticed they buy on dips and sell into strength, but always only a tiny percentage of their stack. I illustrate this type of whale to juxtapose them with new would-be whales who will enter the market having to buy from the already-limited available float, mostly what is available on exchanges, but also to a lesser extent what the miners are willing to sell. So, what’s my point?

The existing whale base helps solidify BTC’s price floor, but they do little to raise it, primarily because they only buy on dips, and even then, they do so patiently and only in small chunks so that price remains largely unaffected.

Now, compare this type of whale to a new whale who comes into the market without a single BTC. If these newbies want to open an Orca-sized position, they need to find 1000 or more BTC on the open market. Even through OTC deals, such new buying will almost certainly move price higher, particularly when institutional FOMO strikes, just as it did last year in Q4, albeit only temporarily.

To illustrate the point, note that Orca addresses increased by 275 over a 43-day period, from their local low of 2117 on December 26 to their ATH of 2392 on February 7. This equates to an average of 6.4 new Orcas every single day during that period. That is a TON of new capital flowing into BTC, and given that the bull run was already well underway by then, the available float was already tight. Price simply had nowhere to go but up, which of course is a very different dynamic from when long-term whales are essentially trying to prevent the floor from completely collapsing during corrections.

All of this is to say that existing long-term whales are invaluable because they help solidify the floor undergirding BTC’s price. Moreover, some new whales also become acolytes (look no further than @michael_saylor), meaning that not only is the price floor solidified by existing long-term whales, it is also ever-so-slowly increased in height by new whale acolytes who more-or-less take a huge chunk of BTC out of the float forever. Bless these whales endlessly, full stop. HOWEVER…

In the absence of a barnstorming by new whales, BTC’s potential upside is not only capped, but PA will generally be more susceptible to the whims of retail sentiment and occasional volume spikes.

For this reason, I personally am praying that new institutional investors start piling in over the coming months. Otherwise, price will continue getting jerked around like a rag doll in the mouth of a pit bull. Of this, I am certain.

So, will we get an influx of new institutional investors?

Over the long run, no question. In my opinion, BTC’s network effect is immutable at this point. i.e., For those willing to wait a few years, there is absolutely ZERO question in my mind we will have added a 0 to BTC’s price by then. It is all but certain in the absence of a fatal network flaw; it is the reason PlanB’s S2FX model predictions will prove correct even if not uniformly along the predicted timeline.

All this said, neither does this mean we will see a new ATH price anytime soon. Or even if we do, it won’t be sustainable, at least not without an influx of new whales. It’s just that simple. I have no doubt.

Regardless, I do think US institutional money will start flooding in during Q4 2021 for three reasons: 1) the global economy is still teetering on the brink of disaster and seems irretrievably broken; 2) US institutions will start buying more of everything very soon, including BTC; and 3) I think a US-based BTC Exchange Traded Fund (ETF) will be approved as projected. I would therefore go as far to say that I would be shocked if we don’t see a spike in institutional demand soon. My only concern is an exogenous global shock that derails all markets. Such a shock would actually be welcome from my perspective for several reasons, but that is an article for another day. But suffice it to say that for now, yes, I think we will see renewed institutional demand, and soon. And if we do, price will substantially and sustainably start moving higher shortly thereafter, just like it did in Q4 2020. But without new whales, PA will continue to ride the rollercoaster of retail whims and occasional volume shocks. This conclusion really seems incontrovertible at this point. As such, fingers crossed we see a new pod of whales soon because I for one could use a break from the yo-yo that is BTC’s price.

Parting Thoughts

All of the following are only my opinion, but I think they merit consideration:

Be wary of claims about whale-sized exchange outflows. All exchange outflows are important, but only if they are not offset by other inflows. I too often see proclamations about this or that outflow on Twitter. Heck, I am guilty of the same. But remember that only aggregate outflows matter, not any one particular outflow, no matter how large (the same is true for inflows, incidentally).

I cannot explain it, but there are often HUGE discrepancies in the on-chain data (and related analyses) I see tweeted vs. the data I collect and analyze. For this reason, I have come to rely solely on my own data collection and analysis. I am not suggesting you do the same, but ask yourself this: how many times can widely followed on-chain analysts make wrong price-trend predictions, provide wrong price-floor estimates and/or fail to correctly foresee price reversals before one should conclude that their “insights” are nothing of the sort?

On the flipside, and in fairness to all on-chain analysts, I have come to realize that even a full complement of on-chain data provide only a partial picture of the state of the market. i.e., At this point in time, derivatives markets have a huge impact on PA, yet no one seems to have a good handle on their impact. I see some analyses of open interest, put-call ratios, funding rates, etc., but no one seems to be able to synthesize these data into any useful insight into future PA other than the occasional “funding rates are running hot” type of analysis. Instead, all we seemingly can do right now is look at reversals post hoc and try to explain why this or that happened (e.g., the impact of futures and options contract expirations at the end of each month, the depth of corrections due to the aggregate amount of leverage liquidated, etc.). All of this is to say that as BTC’s market matures and expands, it will become increasingly complex and therefore harder to predict PA using any one form of analysis, on-chain or otherwise.

It is because of my realization in #3 above that I have decided to go back to the basics for future market analysis, focusing solely on spot demand to try to identify price trends. Hence this analysis, in fact. The good news is that there simply is no other market on the planet that relies more exclusively on supply and demand than crypto, and with its known finite supply, this is most true of BTC compared to any other crypto. As such, I do think, at least for now, we can use changes in whale addresses as a reliable indicator of future price movement, especially when changes in whale addresses are rapidly escalating or declining.

I will close on this note. I wish you all the best in your investing and I will definitely, both more often and more explicitly, highlight on Twitter any address changes that I think are worth noting. By all means, please do give me a follow if you think such notifications might be worth your time, with the understanding of course that you will also have to endure all of my gibberish in between.

Go #BTC.

Was expecting more comments, great article.

Great analysis, thanks!