Disclaimer

The on-chain data I use (BitInfoCharts, Bybt, CoinMarketCap) to compile the tables and graphs contained in this analysis do not always align with the on-chain data found via others sources like Glassnode and CryptoQuant. I cannot fully explain the reason for the differences nor can I confirm which sources are most accurate. For this and other reasons, I have come to trust only my own analysis when trying to explain and/or predict Bitcoin’s price action (PA). Whether you too find my analysis useful is for you to decide, but I can assure you that some of my observations and/or predictions differ, often markedly, from other observations and/or predictions you may see on Crypto Twitter (CT) and elsewhere.

Introduction

Below are three tables illustrating changes to the distribution of active Bitcoin (BTC) addresses and coins throughout the month.

The legend for each of the above tables is as follows:

Analysis

August 2021 was generally a good month for Bitcoin (BTC) in terms of price action (PA). Opening the month at $41,495 (on Coinbase), it closed at $47,113, up 13.5%. However, momentum stalled the fourth week of the month, when price spent about 18 hours hovering above $50K on August 23 before eventually closing the day at $49,507. Price slowly bled the rest of the month from that high-water mark, putting in a series of lower highs and lower lows along the way. The question then is whether there is anything in the distro data that could have foreseen, or at least explain post hoc, the reason momentum waned the final week of the month. Indeed there is.

As shown above, the whales (and specifically whales that trade on Eastern Hemisphere (EH) exchanges, as illustrated later) sold into the bullish price momentum leading up to the high-water mark on August 23. Note that 10 whales devolved during the month, and specifically the final week of the month, after, e.g. Blue Whales peaked on August 24. Conversely, retail investors (Minnows and Fish, and to some extent, Tiger Sharks) all peaked near the end of the month, either on August 29 or 30. The whale devolution during the final week of the month is the reason price stalled at $50K. i.e., For whatever reason, EH whales in particular decided $50K was the price at which to liquidate, thereby creating considerable resistance to further price increases. Once price was firmly rejected at $50K, momentum began to fade.

The silver lining, however, is that retail adoption still peaked near the end of the month despite price being rejected at $50K the week prior. As shown above, active addresses for both Minnows and Fish peaked on August 29 and faded only slightly the final two days of the month, as some of these investors fled to chase alt dreams (some alts like $SOL started spiking right at the very end of the month). Still, the fact that retail investors kept joining the network throughout the month despite the start of a pullback is very encouraging for the long-term health of the network. This trend can be seen below in the year-to-date changes in network adoption:

As shown above, 327.7K new/returning addresses were active in August, with the month ending at its second highest number of active addresses ever (38.614M), falling only 300K short of the all-time high (ATH) set in April of this year (38.921M). On the other hand, these data also show that investor groups must all be rowing in the same direction for price to continue climbing. As shown above, August is yet another low-water mark in terms of the number of whales, with 16 fewer Blue Whales in August than January and an astounding 308 fewer Orcas. While it is possible some whale wallets have been subdivided into smaller wallets, this possibility most certainly does not fully explain the continual decline in active whale addresses throughout 2021. Unfortunately, I did not begin actively recording distro data until January of this year, but I did monitor these data during the latter half of 2020 and whale addresses (and coin accumulations) at that time steadily increased right into the end of the year.

Stated differently, and as I’ve stated on multiple occasions in these month-end distro analyses and elsewhere, BTC’s price can sustainably appreciate at current levels only if whales start (re)joining the network. i.e., The data clearly show that the current rebound from the June low of $28.8K has been driven by retail adoption, so if BTC is to appreciate even more in the months ahead, it will require substantially increased institutional investment, which I do believe will come, as explained later.

It is also important to note that whales are not a monolith. On the contrary, as shown below, three of the largest EH-based exchanges (Binance, OKEx and Huobi) all had sizable inflows during August, while Coinbase, a WH-based exchange, had a sizable outflow. In other words, it appears EH whales have been the primary sellers while WH whales have been net buyers. The one exception to this trend is Bitfinex, which is based in Hong Kong and had an 8K outflow. Still, the trend is clear: coins flooded into EH exchanges in August while outflowing from WH exchanges.

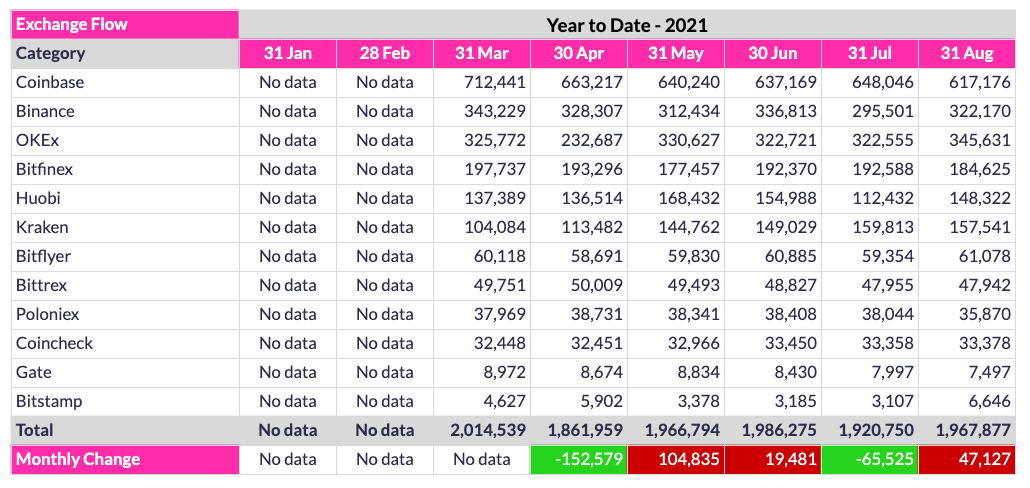

Looking across 2021 to date, the table below shows that total coins on exchanges were still lower at the end of August (1.968M) than at the end of March (2.015M) but that exchanges in aggregate experienced a 47.1K inflow in August, ending the month at their highest level since June. This trend will need to reverse once again if BTC’s price is to move sustainably higher in the months ahead.

Looking Ahead

As I have explained on Twitter and elsewhere, I believe seasonality now plays a role in BTC PA because of the emergence of institutional involvement in the market. Specifically, the adage “Sell in May and go away” seems particularly relevant to US institutions. i.e., Market activity among US institutions decreases during the summer months across all markets, from US Memorial Day (the final Monday of May) until US Labor Day (the first Monday of September). The graph below clearly illustrates this drop in trading volume, with trading volumes during the summer less than half of what they were between January and May of this year.

Admittedly, this drop in volume is not due solely to US institutional trading practices; price action also played a role. i.e., When BTC kept making new all-time highs earlier in the year, interest in the market kept increasing, as one would expect. Then, after the 50%+ correction began in mid-May, market activity waned, again as one would expect. Still, summer plans, especially after the previous 15 months of COVID lockdowns, all but ensured a quieter summer among investors, particularly those based in the US.

The question now is what can we expect with summer coming to a close. In my opinion, I think we will see a noticeable uptick in volume starting mid-September for the reasons I described above. Note that increased volume does not necessarily indicate which direction price will move, only that whichever direction price is moving will be more sustainable due to the increase in volume.

As shown below, September has not been kind to BTC historically speaking. With the exception of a strong 2012 (+22.0%), September PA has typically trended lower.

That said, for the reasons I explained in this article, there is no reason to assume September 2021 will be a down month merely because it has been a down month the past four years and seven of the previous ten. Put another way, while seasonality is indeed beginning to exhibit an influence on the market due to increased institutional involvement, there is no reason to think this September will be a down month simply because it has been more often than not in Septembers past. The PA of several recent months illustrates why a belief in month-based trends is misguided, if not in the past, then certainly now forward.

As shown above, March through June 2021 all ended counter to their respective historical trend: March 2021 was an up month (+30.0%) despite being a down month in seven of the previous ten years, while April, May and June 2021 were all down months in 2021 despite being historically good months for BTC.

For this reason, it makes more sense to try to ascertain future monthly performance by looking at the month’s location within the halving cycle as opposed to its location on the annual calendar.

As shown above, historical PA suggests BTC bull phases last about 19 months (and so-called “crypto winters” only 11 months, not three years as commonly claimed), with this coming September being month 16 of the current bull phase. Because of the 3-month swoon from April through June this year, I expect September to trade near-flat, or perhaps modestly to the upside, simply because the preponderance of months during BTC bull phases are green. That said, given that both July and August 2021 were strong months to the upside, with a cumulative increase of 36.6% off the June low, it is possible September will trend lower, but again, only mildly so if at all. Either way, I expect a very strong Q4, with price starting to run hard in October right through the end of the year, which if it happens, will validate the thesis that we are both in the midst of a double-peak cycle like 2013 and that this year’s PA is unfolding similarly to last year’s PA, both claims I have been making long before they became fashionable.

The reason I believe we will see an especially strong Q4 is NOT because past Q4s have been bullish, but because I expect US institutional investment to escalate in Q4 and because I think a US BTC Exchange Traded Fund (ETF) will be approved.

Unfortunately, the latest rumor suggests that a BTC Futures ETF will be approved rather than a BTC Spot ETF. This is NOT good news for the market, in my opinion, because unlike a spot ETF, a futures ETF will be pegged to expectations about BTC’s future price action as opposed to the inherent demand for BTC. Stated differently, a futures ETF will be yet another derivative product, so its demand dynamics will differ to the organic demand for spot BTC per se (see, e.g., explanations of contango and backwardation here and here as they relate to futures contracts). Moreover, the nature of futures markets will also inhibit faster/wider BTC adoption, given that the investors likely to buy a futures ETF are more likely to be institutional traders that use exchanges like the Chicago Mercantile Exchange (CME) as opposed to, e.g., retail investors and would-be institutional hodlers that would otherwise buy BTC through spot exchanges like Coinbase and Binance.

The distinction between a spot ETF and futures ETF is so important that I think the the US citizens among us should be lobbying the US Congress to persuade Gary Gensler (Chairperson of the US Securities and Exchange Commission (SEC)) to reconsider his preference for a futures ETF over a physically settled ETF that would require spot purchases to satisfy investor demand.

Regardless, the approval of any US BTC ETF will, at least temporarily, be a strong catalyst for the bulls. I am therefore hopeful that the initial bullish reaction to even a futures ETF will induce enough FOMO that it becomes self-reinforcing. i.e., While a BTC futures ETF might not result in a lot (any?) spot buying, it should provide enough positive sentiment to kickstart some serious FOMO, especially if coupled with other positive news (e.g., signs of early success with Bitcoin as legal tender in El Salvador, the announcement of another large company initiating a position, etc.). Once FOMO starts, it should propel price higher right into the end of the year, much like last year.

Conclusion

By all accounts, any month that ends up 13.5% is a good month. That said, the final week of August was somewhat anticlimactic after price crested $50K on August 23. The loss of upward momentum is clearly attributable to whales selling into the modest retail FOMO that developed, and specifically the whales that trade on Eastern Hemisphere exchanges. Early indications are that whale devolution is continuing in September, a trend we clearly want to see reverse sooner than later. That said, US Labor Day is only five days from now (Sep 6), so I suspect US institutions will start ramping up their market activity within two weeks. We will be able to test my thesis by watching daily trading volumes. Either way, we should also get a better sense of market sentiment soon. In the meantime, there seems to be neither much sell pressure nor buy pressure. Retail investors (excluding retail speculators who will FOMO in when price is peaking later in the cycle) are seemingly “all in” right now (whether in BTC or alt coins), so additional upside is unlikely without a significant boost in institutional investment. On the flipside, existing whales seem content to sit on their stacks, at least until price shows renewed strength, in which case they may resume selling. Long and short, BTC is in limbo at the moment. The question is, which direction will it break once US institutions return in earnest. I suspect to the upside for the reasons I stated above, and quite possibly strongly so, if a US BTC ETF is approved in October, which seems to be most likely scenario right now.

Go #BTC.