Month-End Analysis

August 2025

Disclaimer

The data I use (BitInfoCharts, Coinglass, CoinMarketCap) to compile the tables and graphs contained in the on-chain section of this analysis do not always align with data found via others sources like Glassnode and CryptoQuant. I cannot explain the reason for the differences nor can I confirm which sources are most accurate. For this and other reasons, I have come to trust only the on-chain data I collect when trying to explain and/or predict Bitcoin’s (BTC) future price action (PA). Whether you too find my on-chain analysis useful is for you to decide, but I can assure you some of my observations and/or predictions will differ, often markedly, from other observations and/or predictions you will see on Crypto Twitter (CT) and elsewhere.

Price Action

Open (on BLX): $115,754

High (on Aug 14): $124,449

Low (on Aug 30): $107,453

Close: $108,840 (-5.99%)

Tables

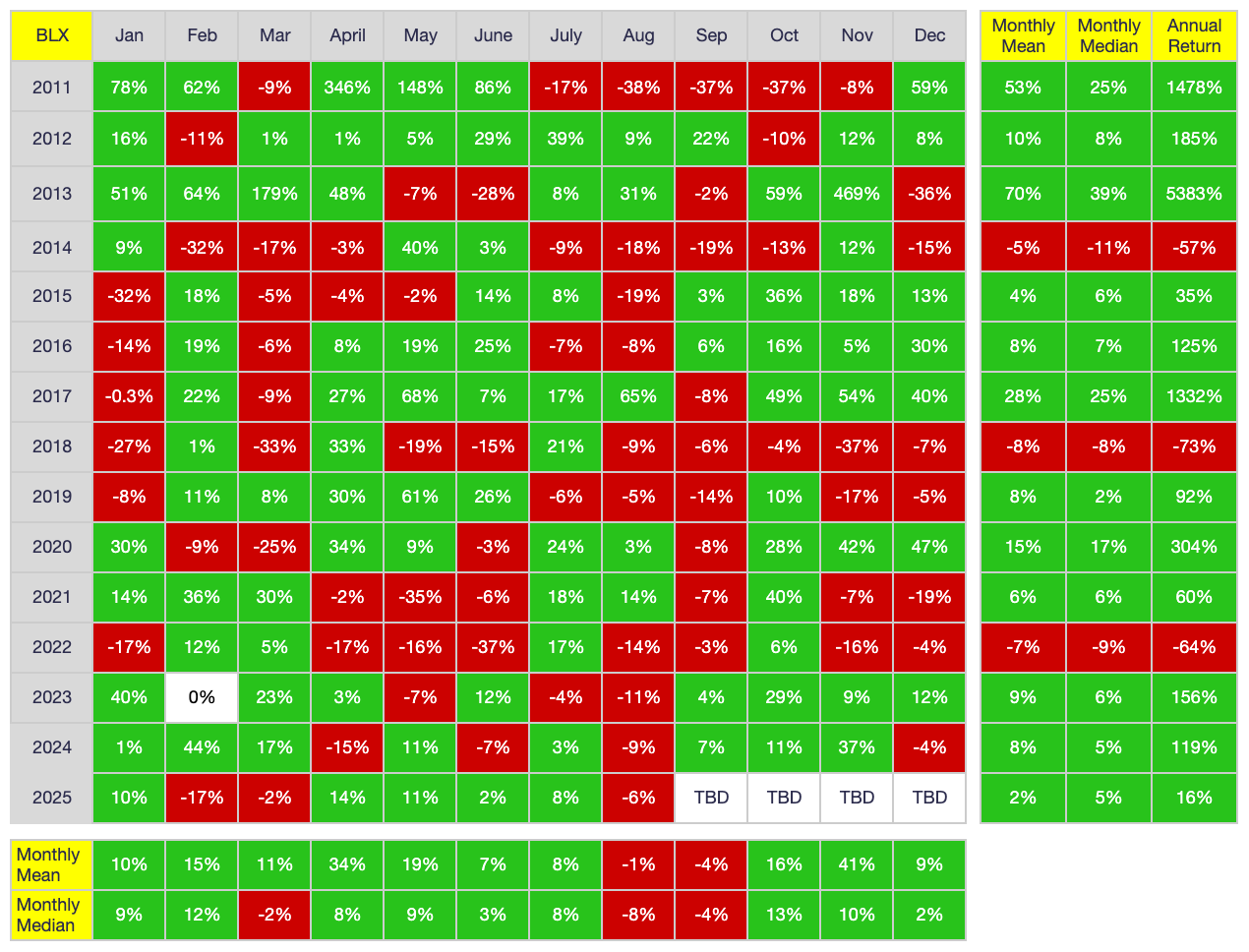

Calendar-Month Returns

TL;DR: From a calendar-month perspective, August is beginning to rival September for most bearish month of the year, having now closed lower four consecutive years.

Halving-Cycle Returns

TL;DR: As anticipated and as shown above, BTC finally pulled back a bit after a 4-month win streak. While unpleasant, particularly after hitting a new all-time high on August 14, a modest pullback in August is both reasonable and healthy.

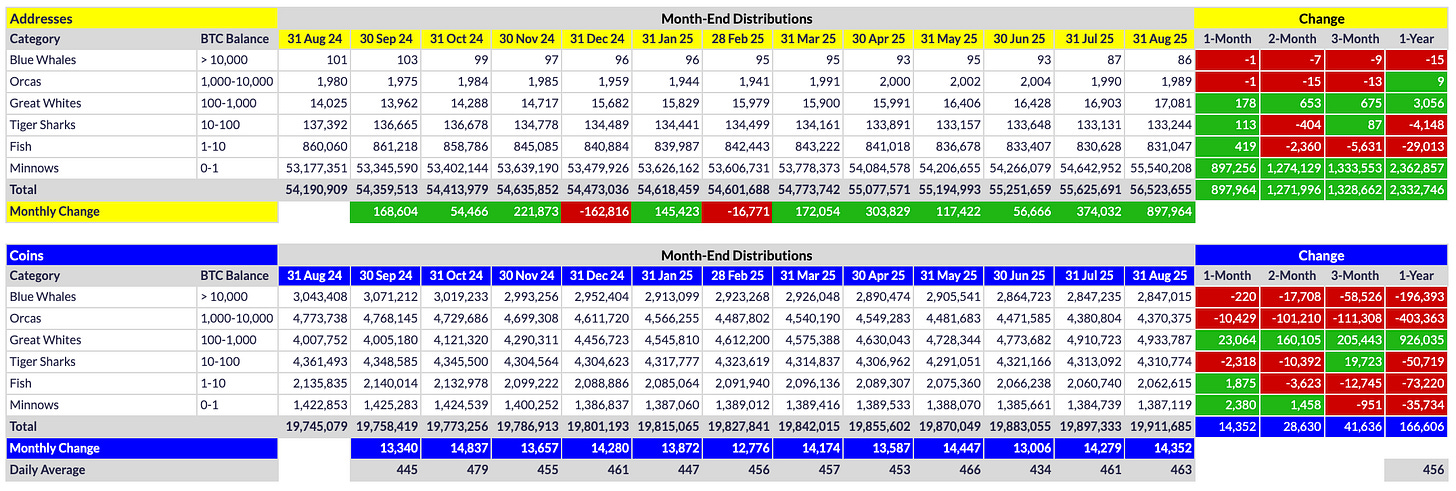

Address and Coin Distributions

TL;DR: Despite substantial price volatility, whale distributions were modest overall. Whales in fact were net accumulators for the month until a handful dumped in unison at the very end of the month. Still, coin distros were mostly neutral for the month, with only modest whale distributions and solid growth among Fish and Minnows.

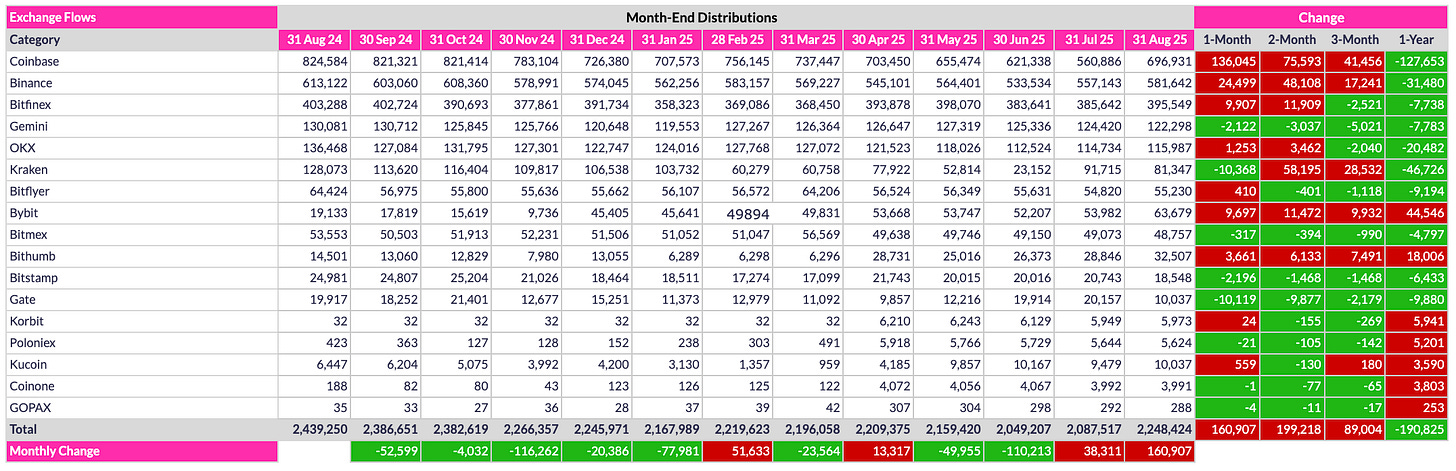

Exchange Flows

TL;DR: Exchange flows were the most bearish metric of the month, with the greatest monthly inflow and first back-to-back monthly inflows since 2022. A handful of OGs were primarily responsible for this inflow, but as shown below, institutional market participants contributed to the inflow as well.

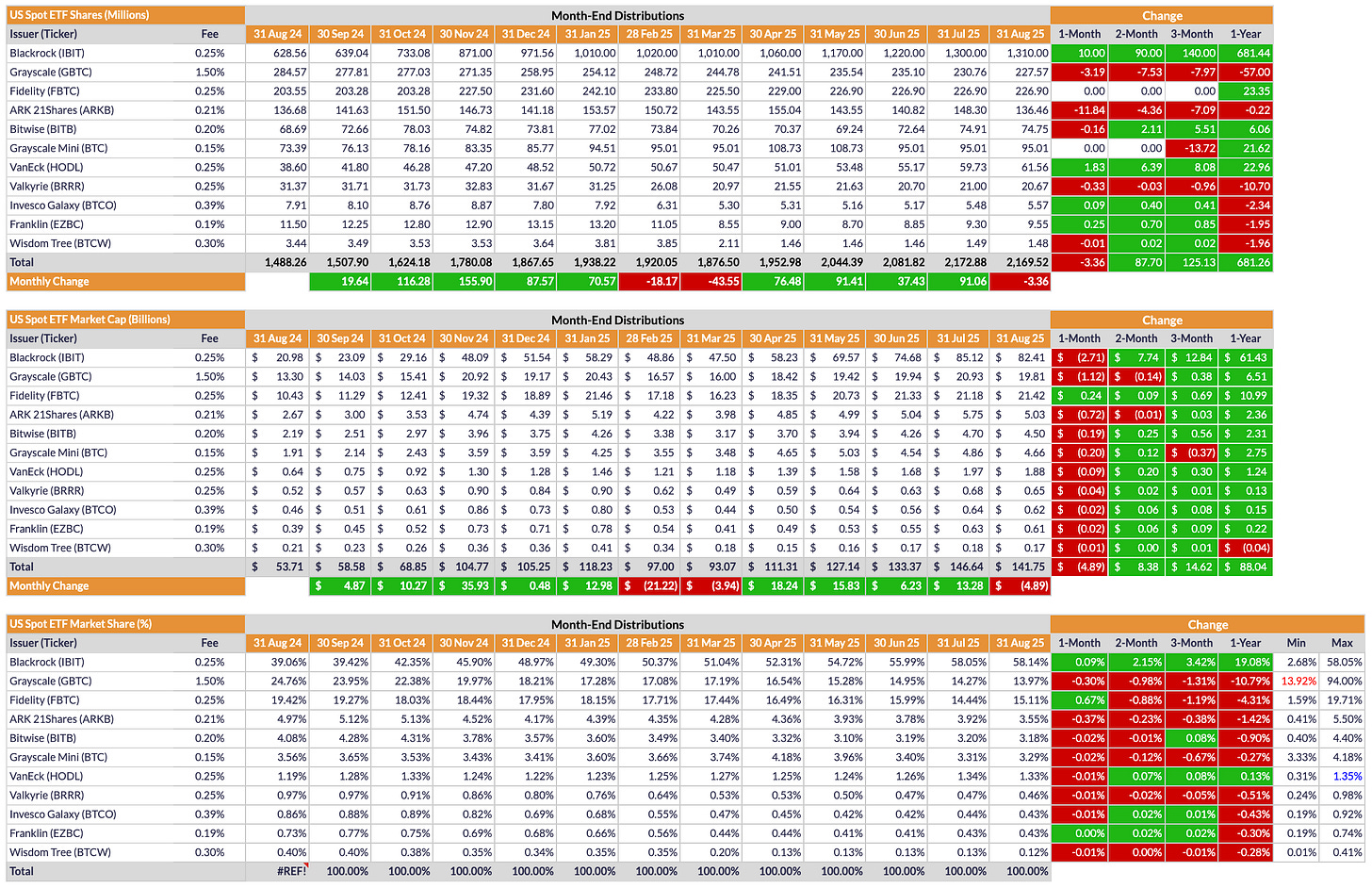

US spot-BTC Exchange Traded Funds (ETFs)

TL;DR: For the first month in six, US spot-BTC ETFs contracted, though IBIT once again eked out very modest growth. Still, it was a bearish month overall for ETFs, which explains in part the net exchange inflow that occurred in August.

Conclusion

Although discouraging, BTC was somewhat due for a pullback in August after “up only” the previous four months. Five-month winning streaks are exceedingly rare, even for BTC, having happened only three times before (once each in 2012, 2016 and 2020). The upside is that we are still in the bull phase of the cycle, so it’s now more likely price will bounce back in September after a down month despite September having a reputation for being a rough month in many markets. That said, it wouldn’t be unprecedented for consecutive down months, so who really knows? No one, of course, but in my opinion, I think the August gloom was overdone, such that I expect a modest rebound in September, followed by a very strong October. Of course, BTC is susceptible to macroeconomic news now more than ever given the level of institutional investment, so anything is possible between now and the end of October. Short of any unforeseeable bombshells, however, I think it is reasonable, even smart, to assume the current BTC bull run still has some room to run. Given that my predictions have been pretty spot on most of this year, there is no reason to think I won’t be correct once again.

Go #BTC.