Month-End Analysis

November 2022

Disclaimer

The data I use (BitInfoCharts, Coinglass, CoinMarketCap) to compile the tables and graphs contained in the on-chain section of this analysis do not always align with data found via others sources like Glassnode and CryptoQuant. I cannot explain the reason for the differences nor can I confirm which sources are most accurate. For this and other reasons, I have come to trust only the on-chain data I collect when trying to explain and/or predict Bitcoin’s (BTC) future price action (PA). Whether you too find my on-chain analysis useful is for you to decide, but I can assure you that some of my observations and/or predictions will differ, often markedly, from other observations and/or predictions you will see on Crypto Twitter (CT) and elsewhere.

TL;DR

Bitcoin ended November 2022 down 19.81%, due mostly to the collapse of FTX.

While there are many reasons to remain bearish, there is at least one glimmer of hope - the rhythm of the halving cycles.

To the extent halving cycles continue to exert at least some influence on price, there is reason to believe the low is now in and December will be an up month.

That said, all bets are off if yet another unforeseen event rocks the global-macroeconomy or the cryptoverse per se.

Price Action

Bitcoin’s price opened November at $20,495 (on BLX) and managed to climb to $21,465 on November 5 before crashing to a low of $15,495 four days later thanks to the FTX debacle. Price finally found its footing mid-month and managed to recover mildly the second half of the month, closing at $16,436. When all was said and done, Bitcoin closed November down 19.81%, the second worst November in its 12-year history (second only to 2018):

As shown above, November is historically a strong month for Bitcoin. Even excluding the otherworldly 469% return of November 2013, November is more often up than it is down. That said, the trend has been negative more recently, with November finishing lower four of the past five years.

When viewing a transposition of the table above, another interesting calendar-month trend becomes evident: how eerily similar 2021 and 2022 are tracking.

As shown above, with the exceptions of January and August, every month in 2021 and 2022 have painted the same color. The bad news, of course, is that December 2021 finished lower, so…

Regardless, as I have stated many times in other articles, I think calendar-month correlations are coincidental in most cases and should not be used to try to infer future PA (with the exception of September). Instead, I think more attention should be paid to where a month falls within Bitcoin’s halving cycle as opposed to where it falls within the annual calendar.

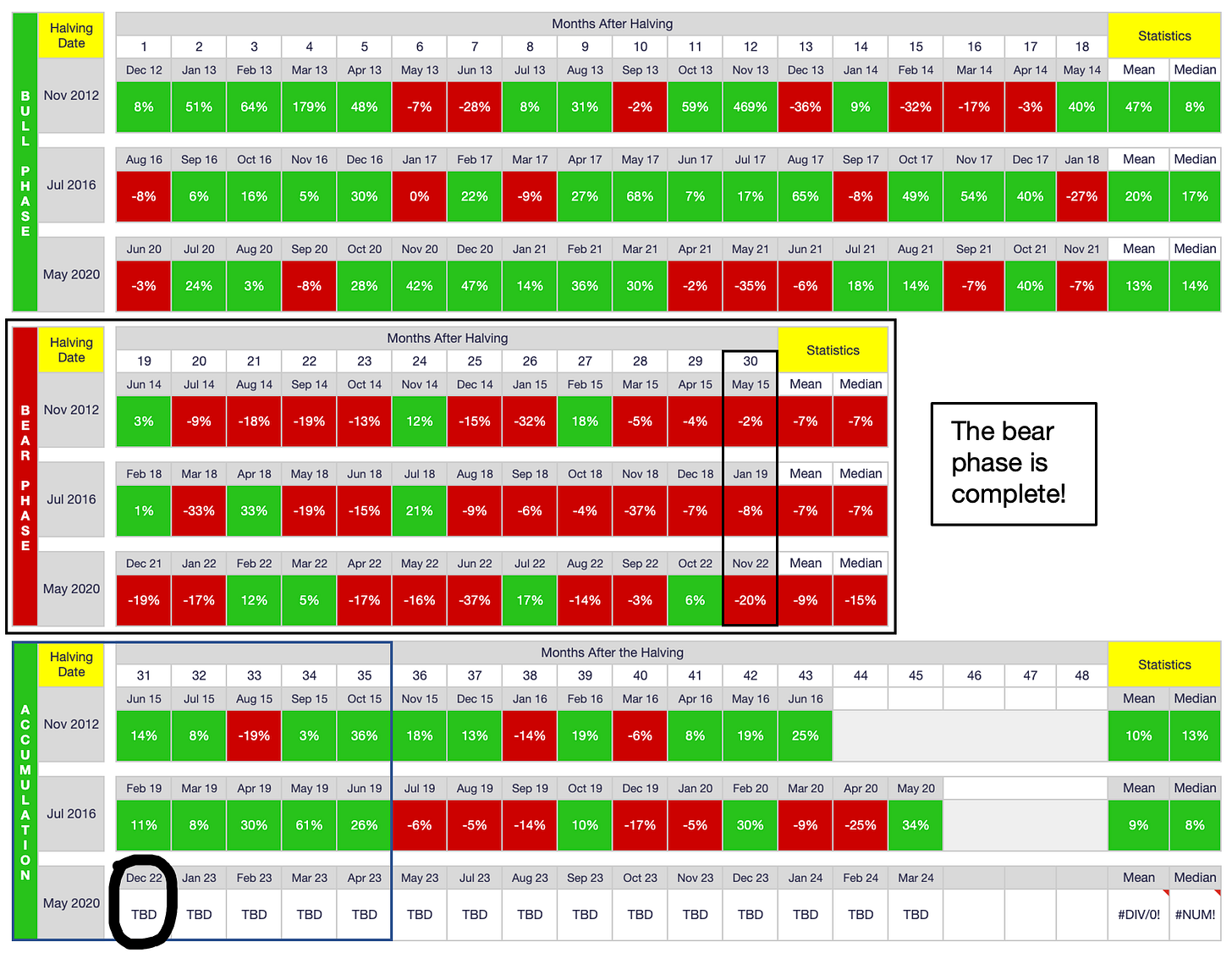

As shown above, November 2022 is thirty months beyond the previous halving (May 2020), which marks the final month of the bear phase, at least for the two previous halving cycles. As such, the lows for Bitcoin should be in now, at least to the extent that halving-cycle PA can be used to infer future PA.

Of course I am cognizant of the myriad global-macro and crypto-specific risks that threaten all markets right now. However, I also have learned over three decades of investing that markets usually turn (both up and down) when investors are most pessimistic/optimistic. This was the case during the dot-com bubble of the late 1990s and again during the so-called Great Financial Crisis of the late 2000s. As such, the optimist in me chooses to believe that the rhythm of the halving cycle continues to exert at least some influence on Bitcoin’s price, and I will continue to believe as such until PA proves otherwise, particularly because investors have never been gloomier than they are right now. In other words, I fully expect December 2022 to be an up month for BTC despite the rampant fear, uncertainty and doubt (FUD) coursing through the veins of many BTC investors.

Conversely, if December does indeed close lower, then it will be strong counter-evidence to the argument that Bitcoin halving cycles continue to influence price, instead supporting the view that Bitcoin is nothing other than a high-volatility risk-on asset that exists within the confines of the global-macroeconomy (and specifically the liquidity conditions of fiat currencies, most notably the USD) rather than a truly uncorrelated asset as so many advocates have proclaimed in the past.

Despite (or perhaps because of) my continued belief in the influence of halving-cycles on price, I do subscribe to the “every fourth year is a down year” calendar-based trend so clearly prevalent throughout Bitcoin’s 12-year history:

As shown above, 2022 is unfolding very much like 2014 and 2018, so in this respect, no matter how dire the current circumstances seem, 2022 really is nothing unusual, at least within Bitcoinistan. As shown in the three far-right columns above, the monthly mean, median and annual returns of 2022 are completely in line with those of 2014 and 2018. Equally importantly are the subsequent-year returns of 2015 (35%) and 2019 (92%). i.e., To the extent that past annual returns are indicative of future annual returns, there is every reason to believe 2023 will be a strong up year for Bitcoin regardless of the pessimism enveloping all markets at the moment. That said, there must be some trend-reversals on chain before such optimism can inhabit reality.

On-Chain Data

Following are the address counts and coin distributions for the past 12 months.

As shown above, network adoption continues its torrid pace despite the gloomy backdrop present throughout 2022. A staggering FOUR MILLION new network addresses have been created over the past year, providing the clearest evidence yet that Bitcoin is following the same trajectory as other technological innovations. Metcalfe’s law, the network effect and the Lindy effect are all as robust as ever.

That said, look at the Orcas: a contraction of 64 the past 30 days alone and 125 the past year. Perhaps more importantly, this contraction led to the dumping of a staggering 221.8K coins in November and an unbelievable 670K coins the past year.

As I pointed out more than a year ago, Orca trends unequivocally foretell future PA. I have never had more confidence in this indicator than I do right now, with their near-relentless contraction throughout 2022 providing only the most recent evidence:

It is for this reason alone that I worry about near-term PA, much more than I worry about, e.g., inflation, another kinetic war or another FTX-like meltdown occurring. Long and short, until Orcas stop devolving, price will continue dropping. It is just that simple. I don’t care what chartists think; I don’t care what economists think; I don’t care what shamans think. When Orca-counts finally stabilize and start increasing again, so too will price. But the opposite is also true. If, e.g., miners continue capitulating and/or other institutional investors continue reducing/liquidating their positions, price will keep falling. I don’t care how many new retail investors join the protocol. It is a simple matter of purchasing power. One Orca has the purchasing power of ONE HUNDRED THOUSAND retail investors. Think about that. If, e.g., on-chain data reveal an increase of 10 Orcas, that is equivalent to ONE MILLION new retail investors joining the protocol. So yes, while the Bitcoin maximalist in me loves the exponential retail adoption that is occurring, the now-retired investor in me wants to see a reversal in the current Orca trend sooner than later because price simply will not recover until a deluge of new Orcas join their pod. It is just that simple.

One other comment regarding this month’s on-chain distributions:

As shown above, and certainly unsurprising to anyone who pays any attention to what is happening in the cryptoverse, centralized exchanges (CEXs) experienced a massive net outflow in November, to the tune of 108.5K coins. Without taking the time to confirm, I think this is the single largest monthly exchange outflow this halving cycle and possibly ever. Of course, when one of the most celebrated CEXs turns out to be a ponzi scheme, investor loss of confidence is to be expected. As such, while exchange outflows are typically considered bullish for PA given that they reduce available liquidity for new buyers, November 2022 is clearly the exception.

Interestingly, however, note the clear demarcation between the exchanges that had net outflows versus net inflows. US-based exchanges (Coinbase, Gemini and Kraken) had a combined outflow of 184.5K coins while overseas exchanges (Bitfinex, OKEx and Huobi) had a combined inflow of 102.8K coins. I won’t comment on the reasons for this demarcation I because I frankly think it is irrelevant. Instead, I choose to focus on the one silver lining of the FTX debacle: it catalyzed many investors, both large and small, to learn about the value/importance of self-custody, thereby not only reducing CEX liquidity but also potentially (re)catalyzing a move toward financial decentralization. In short, and with full empathy for the incalculable pain caused by FTX’s collapse, this tragedy will likely refocus attention on Bitcoin’s raison d'être: providing the globe with a decentralized, uncensorable peer-to-peer network upon which value can be transferred.

Conclusion

November PA and on-chain data yield plenty of grist for both bulls and bears. The former can pin their hope on the rhythm of past halving cycles, which suggests the bear phase of this halving cycle has concluded and reaccumulation is about to begin. i.e., The cycle low is now in, IF of course past halving-cycle PA is at all indicative of future PA. On the other hand, the bears can hang their hats on the adage “the trend is the trend until the end.” i.e., Until Orcas stop devolving and price stops bleeding, there simply is no reason to believe the worst is over, particularly given how gloomy the global-macroeconomy is. That said, and as I intimated above, it is always darkest before dawn and investor sentiment is as dark now as at any point over my thirty years of investing. I suspect a lot of readers did not experience firsthand how frightening the dot-com bubble and GFC were, but I did, so I can assure you that the FUD then was no less compelling than the FUD right now. In short, there is as much reason to believe the worst is behind us as there is to believe it will continue, which of course is to say that anything can happen. Given such coin-flip odds about which way the market will move in December, my vote is for up because that is what Bitcoin’s 12-year history tells us will happen. Here’s to hoping my faith in the rhythm of past halving cycles is well-placed.

Go #BTC.