October 2021 is not like October 2020 (thus far)

How Changes in Whale Counts Foretell Future Bitcoin Price Action

Disclaimer

I always aim to be concise. I rarely achieve my aim.

My Thesis

As I explained in my previous article, my analysis of the on-chain data I track has led me to believe that new whales - and new whales alone - can induce substantial and sustainable gains in Bitcoin’s (BTC) price. i.e., Without a steady influx of new whales, or even worse, in the face of an exodus of existing whales, BTC not only has a much lower price ceiling (due to the relative lack of purchasing power of retail investors), but price is also susceptible to much greater volatility (due to increased liquidity).

The clearest evidence I can provide for my conclusion is illustrated below:

The above illustration should be fairly self-explanatory, but in short, significant changes in Orca counts have preceded significant changes in price very consistently over the past 11 months. And in the short three weeks since I wrote my previous article, there is yet more confirmation of this pattern, as illustrated within the black rectangle located in the far right section of the chart above. As shown graphically, 44 Orcas emerged between September 22 (2,055) and September 27 (2,099) (the lower-right green arrow). This Orca spike preceded the current price spike, which began on September 30 and has since skyrocketed, reaching a local high daily close of $55,340 yesterday, October 7 (as indicated by the upper-right green arrow).

Unfortunately, as indicated by the lower-right red arrow above, Orca numbers have recently dropped off a cliff, with 30 Orcas devolving in the past three days alone (October 4-6). i.e., Orcas have been aggressively taking profits the past three days, which could portend a collapse in price in the near term. That said…

It is important to note that my thesis is NOT that an exodus of whales necessarily means price will soon collapse thereafter, only that price action becomes much more volatile, both up and down, when whale counts significantly drop.

To reinforce my point about increased volatility as opposed to a price collapse per se, note below the two price anomalies over the past 11 months, which seemingly contravene significant changes in Orca numbers: mid-Feb to mid-April (top-center green squiggly) and mid-July to early September (top-right green squiggly).

As I explained in my previous article, these price anomalies are clearly associated with news that triggered sudden shifts in market sentiment. i.e., Because of the significant decrease in Orcas between mid-February and mid-May (331 in total), subsequent PA became much more susceptible to changes in investor sentiment. i.e., Price action became more volatile, both up and down, after the number of Orcas dropped.

If my thesis is correct, then the immediate question is whether we should expect a price collapse in the next week or two due to the sudden drop in Orca numbers over the past three days. Not necessarily. As shown, market sentiment can sustain prevailing price momentum long after whales start devolving.

To further illustrate this point, note that Orcas peaked at 2,392 on February 7 before beginning a long contraction to 2,061, when the number of Orcas finally started leveling out (on May 19). BTC’s current all-time high (ATH) price, though, was not reached until April 13, more than two months after Orcas started devolving. Why the two-month delay in price collapse? Because market sentiment at the time remained bullish throughout most of Q2, at least until price finally collapsed on May 12.

In short, a drop in Orcas does seem to portend an eventual price drop, usually comparable in magnitude to the drop in Orcas, and this is precisely what we saw starting May 12 and lasting until July 21, when price reversed course after @elonmusk expressed some relatively bullish comments amount BTC at the B Word Conference.

So, are we longs doomed given the recent drop in Orca count? Not necessarily, or at least not yet. First, Orca numbers could start trending up again. Look no further than the graph below for such precedent.

As shown above, even during the staggering increases in Orca counts during Q4 2020 and early Q1 2021, there were ebbs and flows along the way. Admittedly, the fact that 30 Orcas just sold into the current price spike isn’t spectacular news, implying that at least those 30 Orcas think BTC price has reached a local near-term peak of +/- $55K. However, it is possible these same Orcas will return to the market if price remains stable or only slightly retraces in the near term. Moreover, it is possible new Orcas will enter the market, if they see potential in BTC’s mid-term price future.

This latter scenario is entirely plausible, in my opinion, given that BTC futures contracts recently entered contango (the expectation that future prices will be higher than today’s prices). Moreover, there is increasing conviction that a BTC Futures Exchange Traded Fund (ETF) will be approved soon in the US, as early as this month, which likely would draw in a huge amount of new institutional capital.

In other words, aside from the fact that prevailing market sentiment can sustain price for at least a while after whale numbers start dropping, it is possible (and most desirable) if a catalyst emerges to draw in a new cohort of Orcas that can not only reverse the Orca drop, but ideally meaningfully increase the number of Orcas.

Even if this proves not to be the case and we have to endure yet another precipitous price decline, there is one shiny silver lining:

The floor undergirding BTC’s price is not only continuing to harden with each passing day, it is also ever-so-slowly climbing due to “bottom feeding” by the overlapping groups of long-term whales and BTC “maximalists.”

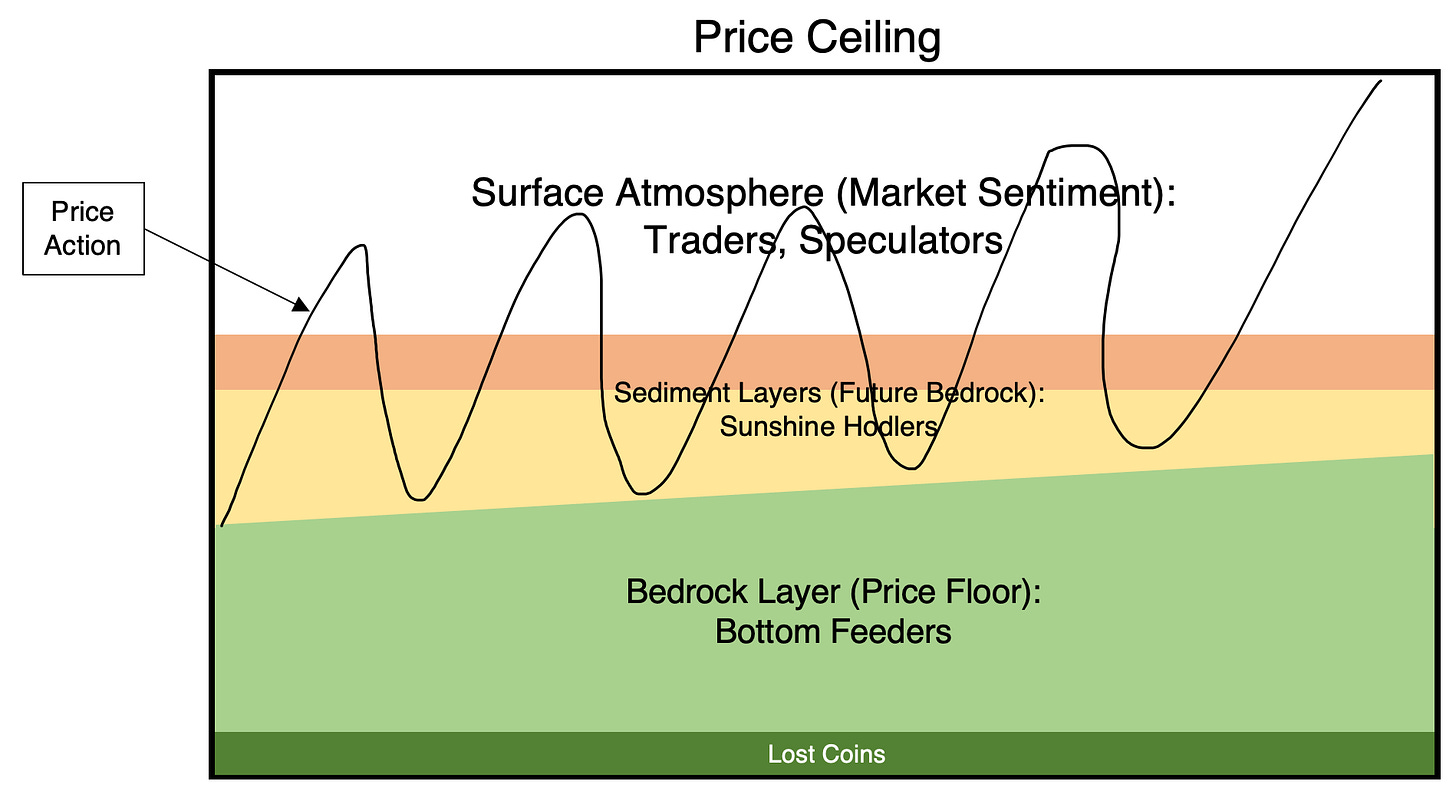

Above is an admittedly crude sketch of how I envision BTC’s investor base and its concomitant price action. The base layer comprises all of the lost coins, coins most likely never to see the light of day again. The exact number of coins lost is unknown but some estimate about 3.7M. Considering the total supply of BTC is only 21M, that could mean almost 20% of the total supply is permanently off the market.

Whatever the actual number of coins lost, there are a number of early investors who hold tens of thousands of coins so deeply in the profit that they simply have no reason to sell much of their stack, potentially ever. Overlapping with this group are the BTC maximalists, those who won’t sell their holdings, potentially ever, because of their fanatical belief in the protocol and its potential impact on society in the coming decades. It is these two groups of investors, combined with lost coins, that comprise what I have labeled the “Bedrock Layer” of Bitcoin. They set the floor on price simply because the vast majority of coins they hold may, quite literally, never be sold.

Equally important, however, is the fact that the bedrock layer increases in height over time. This is because some of these whales do sell a small percentage of their stacks from time to time, but seemingly only to accumulate more coins on subsequent dips. The single largest non-exchange whale wallet is the best example of such behavior:

As shown, this Blue Whale (BW) has sold coins at 56 different points in time (Outs = 56). That said, they have purchased coins on 457 occasions (Ins = 457), indicating that they buy 8x as often as they sell. Moreover, and despite selling 3,000 coins yesterday, sadly, they hold nearly 110K coins in total. i.e., This BW is an uber hodler that seemingly tries to increase their returns and/or total number of coins over time, an admirable behavior indeed. i.e., Such “bottom feeding” helps not only solidify BTC’s price floor but it also incrementally increases the floor over time, which is why, in my humble opinion, BTC will almost certainly never go below $30K again, or possibly never even below $40K again. There have been enough newly minted maximalist whales over the past year that not only helps strengthen the price floor but also permanently raises it (in the absence of some cataclysmic global event, that is).

The next two layers of the investor base are what I call the “Sediment Layers” - investors who initially entered the BTC market seeking outsized gains but have since been orange-pilled and are now in the market for the long haul. Hopefully.

I include myself among these groups, which is to say I have become a BTC maximalist in spirit, but I still have a family to feed and my gains to date aren’t so ludicrous that I can afford to disregard PA all together. i.e., I hope I can hodl my stack forever, eventually borrowing against or lending my BTC if I ever need fiat currency to pay for legacy financial transactions. However, I - and undoubtedly many others - are not quite there yet, meaning we have sizable gains but not so-called “F@#$ you” money. As such, I continue watching the market like a hawk, ensuring I don’t jeopardize my family’s nest egg, particularly now that I am retired.

All of this is to say that there are a number of investors who are deeply profitable at the moment, true acolytes of the Corn, who for practical reasons simply cannot ride BTC to the canyon floor should such an event ever come to pass. Fortunately, such an event is extremely unlikely, in my opinion, so I am indeed in it for the long haul, hoping that one day my current location within the yellow sediment layer eventually settles for good, becoming a permanent part of the green bedrock layer (NB: I distinguish the orange and yellow layers by degree of profitability, with the orange layer equally convicted about BTC but with far less cushion in terms of profitability).

Finally, there is the area above all of these hodlers that I have labeled the “Surface Atmosphere,” where all of the market traders and speculators reside. It is in this area where price gets tossed around like a rag doll in the mouth of a pit bull. Remember that a market’s price is a reflection of trading at the margins of a market, not at its core. @glassnode estimated last December that 78% of BTC is illiquid, meaning that the PA we stare at day after day on TradingView is a reflection of the trading at the margins of BTC’s supply. The vast majority is held in cold storage, not even within sniffing distance of an exchange.

This in fact is the reason I have come to believe that whale counts alone provide the only reliable indication of the future degree and direction of price moves. When new whales enter the market, they swallow huge chunks of the liquid supply all at once, making an already scarce asset dramatically more scarce in an instant. What happens when demand for an increasingly scarce asset dramatically increases? Price goes up, both substantially and sustainably, at least as long as these same whales hodl their purchases. When they sell, though, the opposite happens: all of the typically smaller retail investors on the buying end of these transactions have far less purchasing power than the selling whales, so it takes A LOT more retail buyers to sustain the prevailing price, even temporarily.

To illustrate this point, note above that the average Orca wallet has a current value of $138.2M (2,553 BTC at $54.1K), whereas the average Minnow wallet has a value of $1,427 (0.03 BTC at $54.1K). In other words, one Orca has the purchasing power of 96,783 Minnows. Let me write that again:

ONE Orca has the purchasing power of 96,783 Minnows.

Do you see the problem I see? When DOZENS of Orcas start selling their stacks, even in part, price simply has nowhere to go but down. There simply aren’t enough Minnows (or Fish or Tiger Sharks or even Great Whites) to absorb such tremendous sell pressure. And then what happens when price does finally collapse? Existing bottom-feeding whales enter the market to devour all of the discounted coins, content to sit on them until the next price spike.

Once again, such price drops are not always immediate, but they are a foregone conclusion in the absence of a whale-count reversal. i.e., Sentiment alone can often sustain the prevailing price trend for at least a while, but if a new cohort of whales does not eventually replace the exiting whales, price will most assuredly drop, and often precipitously, just as it did on May 12, September 7, September 20, etc.

In Sum…

Changes in whale counts are the best and perhaps only long-term predictor of the degree and direction of BTC’s price action: When whale counts substantially increase, price increases soon thereafter, both substantially and sustainably; when whale counts substantially decrease, price decreases thereafter, if not immediately, then eventually.

Because BTC’s current price is at/near $50,000, retail investors lack the purchasing power to establish or reverse price trends. At most, they can sustain prevailing price trends for a period of time before the associated whale-count reversal takes over. Moreover, even on those rare occasions where retail fear of missing out (FOMO) is especially strong (e.g., when Telsa bought BTC or even the fake Walmart press release about Walmart beginning to accept Litecoin as payment), the resulting pump never sustains unless it is soon followed by whale FOMO, which incidentally almost never occurs.

The existing cohort of long-term/maximalist whales (+/- 75 non-exchange Blue Whales and +/- 2050 Orcas) provide robust price-floor support and help to ever-so-slowly increase the price floor by “bottom-feeding” (buying dips). However, they almost never cause increases in price because many of these same whales sell into strength so they are liquid enough to capitalize on subsequent dips.

In short, only an influx of new whales (above and beyond the existing long-term/maximalist whales) can push BTC’s price substantially and sustainably higher. This is the reason whale counts alone and not, e.g., exchange outflows, are the most reliable predictor of the degree and direction of future BTC price action.

Proposed Counterevidence to My Thesis

The disclaimer at the start of all of my month-end distro analyses is this:

The on-chain data I use (BitInfoCharts, Bybt, CoinMarketCap) to compile the tables and graphs contained in this analysis do not always align with the on-chain data found via others sources like Glassnode and CryptoQuant. I cannot fully explain the reason for the differences nor can I confirm which sources are most accurate. For this and other reasons, I have come to trust only my own on-chain analysis when trying to explain and/or predict Bitcoin’s price action (PA). Whether you too find my analysis useful is for you to decide, but I can assure you that some of my observations and/or predictions differ, often markedly, from other observations and/or predictions you may see on Crypto Twitter (CT) and elsewhere.

I reiterate this disclaimer here because I continue to see repeated claims that “whales are buying” and “coins are flying off exchanges.” Nonsense. Neither of these claims is true, at least not recently, according to the on-chain data I track. As many of you know from my daily distro updates on Twitter, these two statements in particular are unfounded, at least in part:

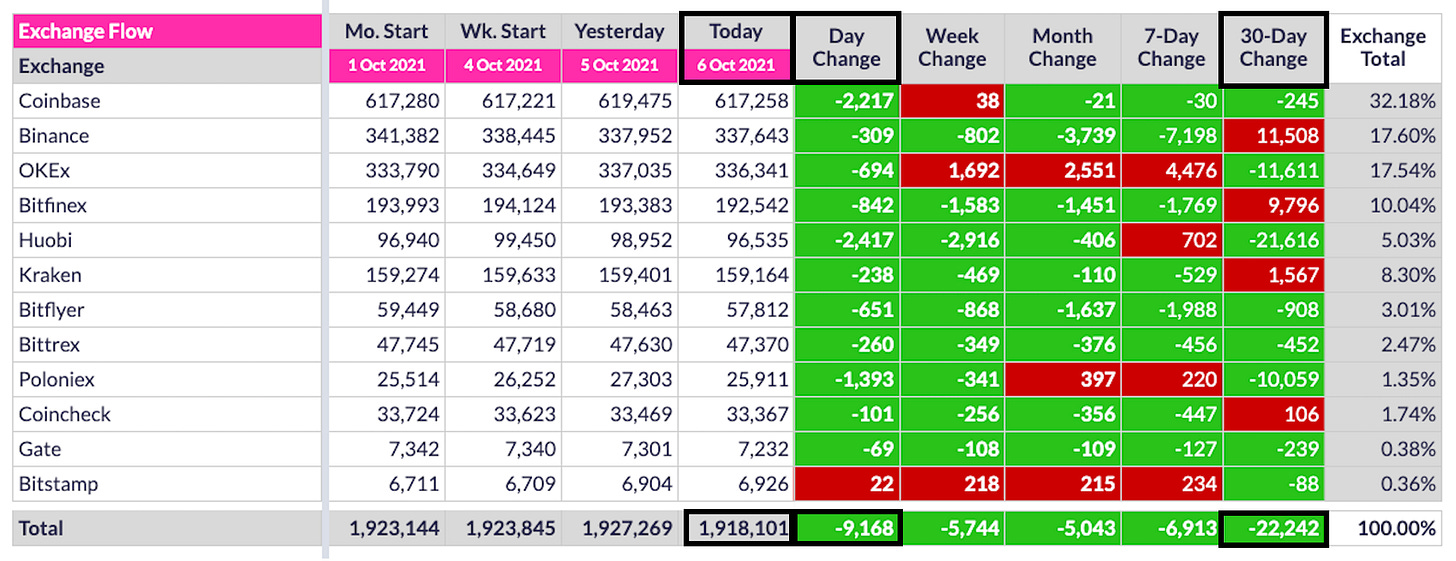

As yesterday’s exchange-flow update above illustrates, yes, 22.2K coins have outflowed from exchanges in the past 30 days, including 9,168 yesterday alone. However, given that there are 1.918M coins on the exchanges listed above, 22.2K is only 1.1% of the listed inventory. Stated differently, 22.2K coins is less than the equivalent of the average holding of a single Blue Whale (31,673 BTC). So yes, there has been an exchange outflow recently, but less than that of a single Blue Whale. Contrast this to last October when @Grayscale was buying, on average, more than the new supply of coins being mined every single day. That’s right: Grayscale alone was buying more than 22.2K coins a month in Q4 2020. As such, a collective 22.2K exchange outflow over 30 days is welcome news but hardly market-altering.

To further the point, note below that the number of coins on exchanges is nowhere near their all-time low despite some recent claims to the contrary. As shown, coins on the listed exchanges reached their nadir in April of this year, ending that month at 1.862M, which is 156K fewer coins than were on these same exchanges yesterday (October 6). So, no, coins are not flying off exchanges. Thankfully, there hasn’t been a spike in inflows, but neither has there been any meaningfully large outflows recently.

NB: The list of exchanges I track is comprehensive but not all-inclusive. e.g., FTX is excluded. However, these are the data I have freely available to me. That said, this list of exchanges includes most of the circulating supply on exchanges and is, at the least, a very good approximation of what researchers call a stratified random sample. i.e., The fact that this list of exchanges does not include every known exchange does not negate the fact that their flows are representative of the entire exchange market.

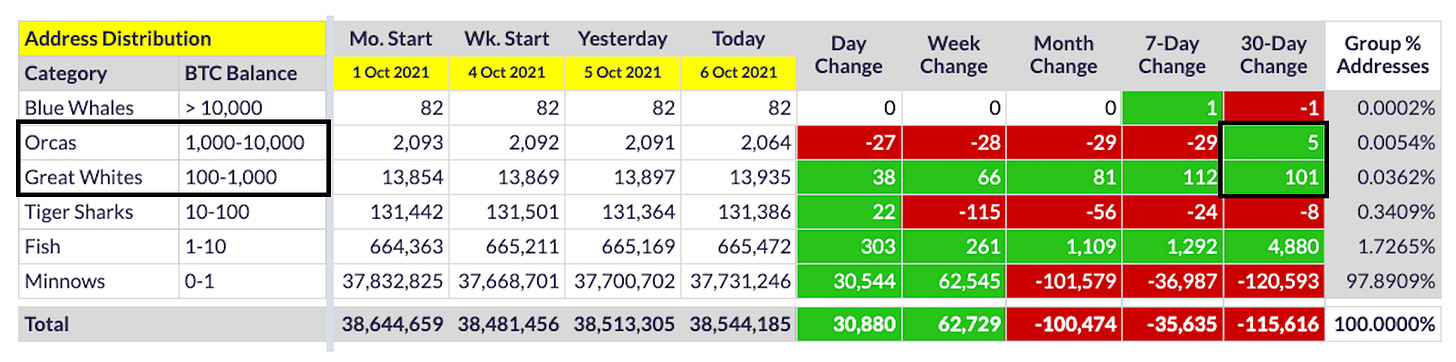

Exchange flows aside, the claim that really perplexes me is that whales are currently buying. As shown below, whales have been huge net sellers for at least the past 30 days, particularly non-exchange Blue Whales, which again, is potentially bad news for price, at least in the absence of an influx of new whales.

As shown above, BWs and Orcas combined have vomited a net of 92K coins in the past 30 days alone. 92,000! No, folks, whales are definitely NOT buying these days. They are selling, and aggressively so.

If there is any reason for hope in the data above, it is that Great Whites (GWs) have absorbed almost all of the vomited whale coins, meaning many of the current GWs are either recently devolved whales (whales that only sold parts of their stacks) or new institutional buyers who are entering the market at the Great White level.

It is this latter hypothesis to which I cling to most when looking for hopium. i.e., It is possible that because of the 3-5X increase in price since December 2020 that new institutional investors are entering the market at a tier lower than they did in Q4 2020, meaning current Orcas could be equivalent to last December’s Blue Whales and current GWs are equivalent to last December’s Orcas. If this scenario proves to be true, there is much more reason for optimism regarding the sustainability of the current price spike.

To illustrate my point above, note that Orcas have increased by five over the past 30 days (despite the mass exodus of 27 yesterday) and GWs have increased by an astounding 101 in the past 30 days. These increases are more reflective of the magnitude of increases in BWs and Orcas, respectively, that occurred last October.

So, is this possible? Might current Orcas and GWs be this year’s equivalent to last year’s BWs and Orcas? Possibly. The problem, though, is that the distro data over the previous 11 months (not shown) suggest that the sharks - Great Whites and Tiger Sharks alike - are mostly momentum traders, jumping into and out of the market over and over and over, which of course exacerbates price volatility, not decreases it, especially when the “only” whales in the market are bottom-feeding hodlers. It is in fact this trading behavior that worries me most when it comes to a potential near-term price collapse (due to spot market changes, that is. Derivatives trading is an entirely different but equally vexing worry, one I will address another time).

Regardless, the bottom line is that the data I track simply do not in any way suggest that existing whales are buying. Quite the opposite, they are selling, and selling aggressively, which again makes me concerned about the sustainability of the current price spike. In my opinion, price will not be able to maintain its current trajectory for long unless a new catalyst emerges soon that draws in a substantial number of new whales (or non-trading GWs). The most obvious way this could happen is if a US ETF is approved; the next best thing would be news of an iconic company (or central bank) having added BTC to its treasury or perhaps another country deciding to adopt BTC as legal tender. Something of that magnitude, but even any one of these catalysts alone may be insufficient to substantially increase the number of institutions initiating new BTC positions. That said, if a series of such events occurred within a short period of time, collectively they might be sufficient to trigger Game Theory, whereby other institutions jump into the market for fear of missing out, which is precisely what happened last October.

What My Thesis Means to My Own Investing Decisions

In short, the on-chain data analysis described above and its concomitant conclusions have no practical impact on my own investment decisions. I am first and foremost a hodler, having taken enough profit earlier to ensure I am sufficiently liquid to support my family without having to sell any BTC any time soon. That said, I do plan to sell some BTC later this cycle, assuming we eventually get a parabolic spike like I expect we will. i.e., I will not sell at that point to lock in profits per se, but only to try to buy even more BTC later, near the nadir of the next bear market (which in my opinion is also inevitable). My approach is a risky strategy indeed, but a risk I am willing to take, at least with part of my stack, because I think I now have a pretty good sense of how BTC’s price action ebbs and flows. Regardless, I am playing the really long game with the majority of my stack until/unless I am forced to consider alternatives.

For what it’s worth, I will share any sales I decide to make at the time of sale if such information is of any value to others when trying to make their own investing decisions. In the meantime, good luck with your investing, and of course…

Go #BTC.

Great write up David! Like yourself I will die in this hill. What do you think is the most likely reason the lag time between orca buying/selling and price rising/falling fluctuates? Take care friend.

Hi David, what do you make of the fact that in 2017 the 1k-10k coin cohort began decreasing at $4K yet the price continued to $20K? They didn't meaningfully begin adding numbers again until Oct 2018, 10 months after the end of the bull market.