Month-End Analysis

September 2024

Disclaimer

The data I use (BitInfoCharts, Coinglass, CoinMarketCap) to compile the tables and graphs contained in the on-chain section of this analysis do not always align with data found via others sources like Glassnode and CryptoQuant. I cannot explain the reason for the differences nor can I confirm which sources are most accurate. For this and other reasons, I have come to trust only the on-chain data I collect when trying to explain and/or predict Bitcoin’s (BTC) future price action (PA). Whether you too find my on-chain analysis useful is for you to decide, but I can assure you that some of my observations and/or predictions will differ, often markedly, from other observations and/or predictions you will see on Crypto Twitter (CT) and elsewhere.

Price Action

So much for the doom and gloom of September trading. After opening the month at $58,996 (on BLX), price climbed all the way to $66,476 (on September 27) before closing the month slightly lower at $63,333. When all was said and done, September closed 7.34% higher, the fourth best performing month of 2024 thus far:

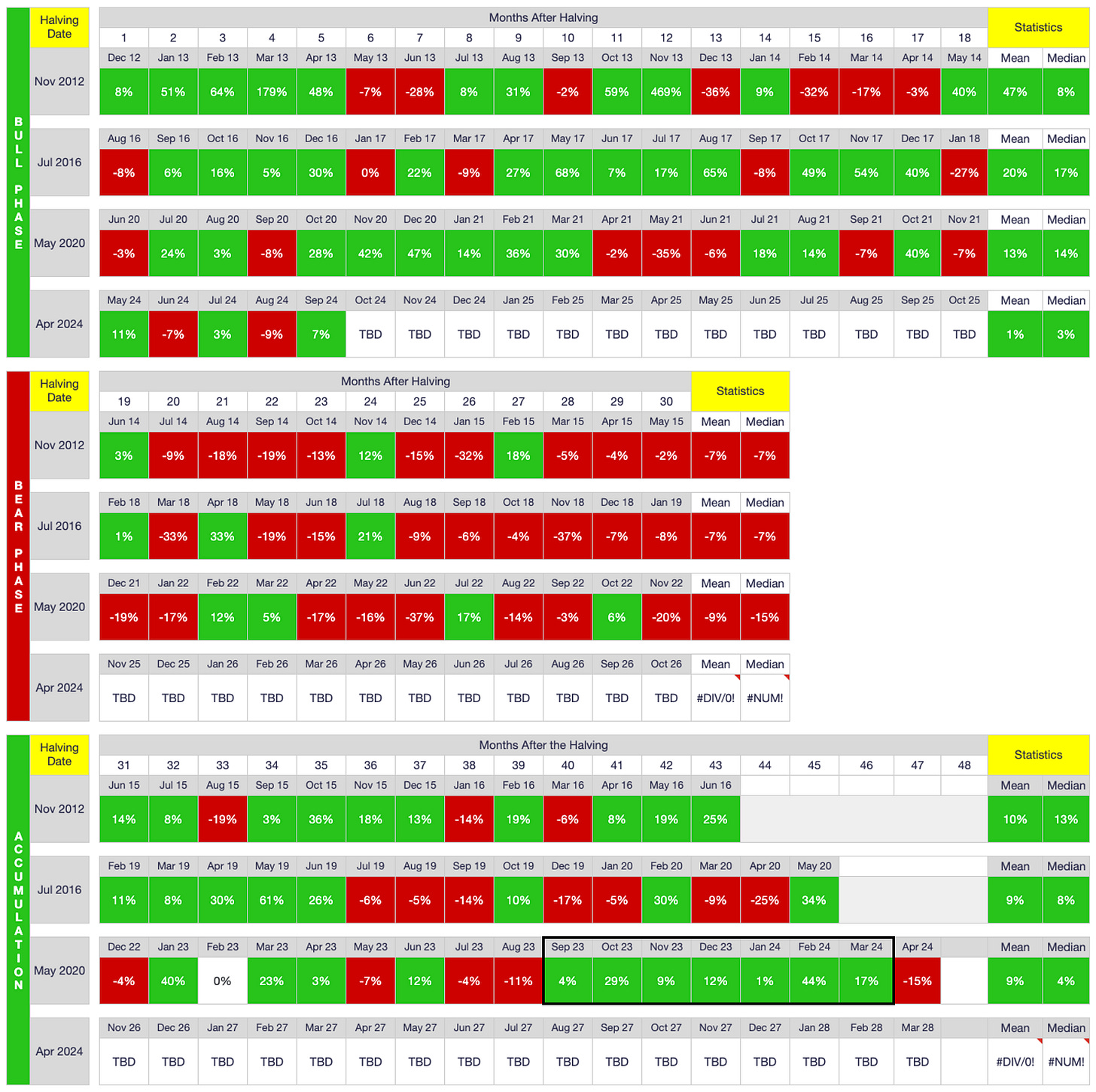

As shown above, only February, March and May have outperformed September in 2024. Moreover, this is the second consecutive year September has closed higher, so can we please dispense with all of the unfounded/recency-biased suppositions regarding calendar-month returns?

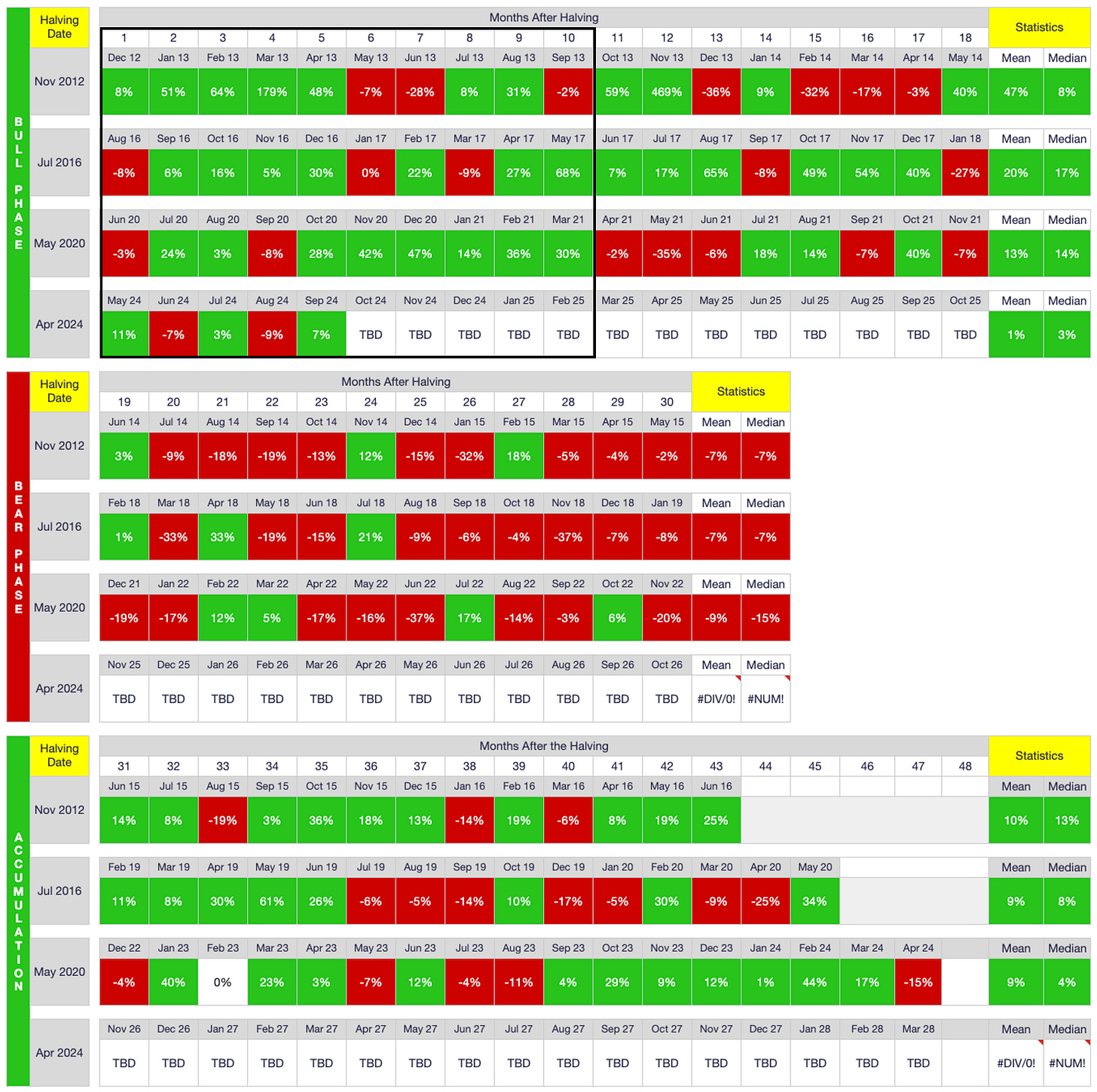

As I have been stating for literally years now, it is not calendar-month returns that matter; it is halving-cycle returns, meaning where a calendar month falls within the halving cycle as opposed to the annual calendar per se. Each halving cycle has followed a particular rhythm in terms of PA and this latest/current halving cycle is no different, at least thus far.

As shown above, the first several months following a halving are bullish for price if not uniformly so. In fact, only once has price closed lower two consecutive months following a halving (May-June 2013), but that dip is easily understood when seeing the absolutely monstrous gains in the five months that preceded the dip (Dec 2012 - April 2013). In fact, it is because of the halving cycle that I made this prediction in my July 2024 month-end analysis:

…it does appear to be a bit of a toss-up as to whether this August will close green or red. Because of August’s historically weak performance, I would lean toward red if forced to choose. Then again, I would be very surprised if both August and September 2024 were to close lower given where we are in the new cycle…

Full disclosure, I ultimately guessed August would close higher and September would close lower rather than vice versa, but more importantly, I was quite confident that at least one of the two months would close higher simply because of the recency of the halving, and that belief has proven correct.

Using the same line of reasoning (the rhythm of the halving cycle), I expect the majority of the next several months to also close higher (through February 2025), but I would be very surprised if they all closed higher. Shocked, in fact. i.e., So much demand was pulled forward by the launch of US spot-ETFs that it has absorbed a lot of the bullishness that otherwise would be beginning soon.

I will further explain my relative lack of bullishness later when I discuss the on-chain distributions for September, but suffice it to say, without a new BTC/crypto-specific catalyst, I am far less sanguine about Q4 2024 than everyone else seems to be even though I am an uber-bull over the long term. Let me return to the calendar-month return table for a moment to explain why:

First, as shown above, October has closed higher the past five years, but it is not universally bullish by any stretch, having closed lower four times as well. Moreover, October isn’t even the most bullish calendar month on average. While it has the highest median return (16%), its average return (also 16%) is only the fifth most bullish behind November (41%), April (35%), May (20%) and February (17%). Regardless, as I explained earlier, I think basing any investment decisions on calendar-month returns is a fool’s errand. A month’s position within the halving cycle is far more important than its position on the annual calendar. As such, I think we have reason to be optimistic about October 2024’s PA not because it is October per se but because it is the sixth month following the most recent halving (which occurred on April 20, 2024).

Having said that, it is crystal clear at this point that the launch of US spot-ETFs in January 2024 has pulled a tremendous amount of demand forward. Look once again at the monthly returns organized by halving cycle:

As shown above, there was a literally unprecedented string of bullish months during the accumulation phase of the previous halving cycle (September 2023 - March 2024). Never before had Bitcoin’s price increased seven consecutive months. It is this seven-month period that encapsulates the launch of US spot-ETFs (in January 2024) along with four months of front-running once it became clear they would eventually be approved. All of this demand is demand that likely would have otherwise emerged post-halving. We are thus now experiencing the hangover of that pulled-forward demand. The quarterly-returns table illustrates this fact even clearer:

As shown above, Q3 2023 and Q1 2024 were monster quarters (57% and 69%, respectively), particularly given the fact they were at the tail-end of the previous halving cycle. While many were postulating such returns were merely the beginning of a supercycle, I had my doubts, positing that it was entirely possible such returns were merely demand being pulled forward and this has clearly proven to be the case. Look no further than the returns of the two quarters since the halving: -12% and 1%.

But isn’t Q4 2024 supposed to be massively bullish because it is a US presidential election year, the global economy is slowing down, central-bank interest rates are rolling over, global liquidity is starting to increase, gold bull runs precede BTC bull runs, and well, just because we “always” have Uptober, Moonvember, and whatever people call December? No, No, Eventually, No and No.

The problem with all of the above speculation is it is macro-based, not BTC/crypto-specific. For those who weren’t around in (or don’t remember) late 2020/early 2021, there was crypto-specific bullish news throughout the entire quarter: Microstrategy’s first purchase, Square’s first purchase, Tesla’s first purchase, even MassMutual bought BTC at the time. Rarely did a day pass without some sort of bullish BTC/crypto-specific news. Contrast that to now. There is absolutely NOTHING bullish happening in BTC/crypto markets right now. Everyone has turned their attention to Artificial Intelligence (AI), not BTC/crypto. So while I personally believe BTC is the single greatest store of value the world has ever known, not everyone else has come to the same realization, at least not yet. In fact, I would argue gold’s current pump isn’t an obvious precursor to a monster BTC pump, it is actually robbing BTC of even more liquidity right now, just as BTC has done to gold over most of the past 13 years. i.e., I think BTC’s very recent returns (within the past three months) have been more muted than they would have been had not so much capital flow into gold recently. Why that capital is flowing into gold is beyond me. Gold literally has no place as a store of value in the digital age (nor does real estate, bonds, etc.). But it has, and so suffers BTC, getting a taste of its own medicine for a change.

Mind you, none of this “bearishness” I am spewing has altered my own investing perspective. I have been hodling strong since $16K and have absolutely no intention of selling a single Satoshi any time soon other than if absolutely necessary for living expenses (I am early retired with no income source other than investment returns). i.e., I am patient because I am very confident BTC will eventually surpass/replace gold as the preeminent global store of value, and when it does, each coin will be worth hundreds of thousands of USD, if not millions. When that will happen is unclear to me, but I can tell there is absolutely no indication right now we are getting any closer to that day. Which again is the reason I am not nearly as optimistic as everyone else regarding October/Q4 2024. Do I think we are due for a return to the days of “up only”? Absolutely. But there are no early signs of that yet. I don’t care what calendar month we are in at the moment.

On-Chain Data

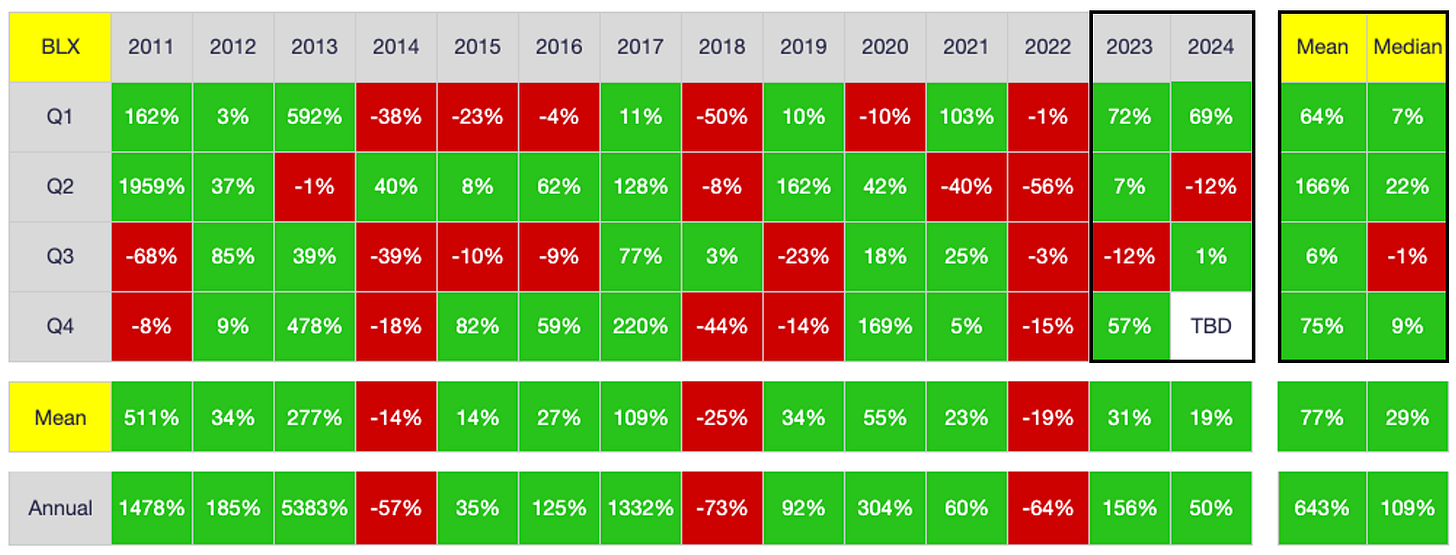

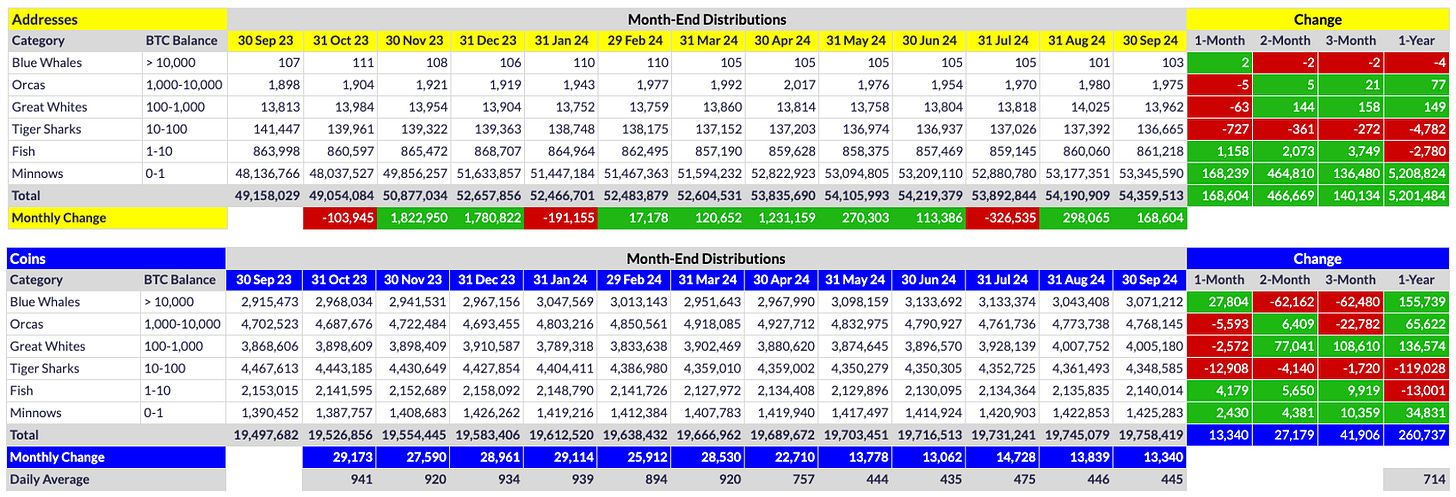

Below are the distribution of BTC addresses and coins the past 12 months, which, incidentally, highlight the reason(s) for my current lack of bullishness:

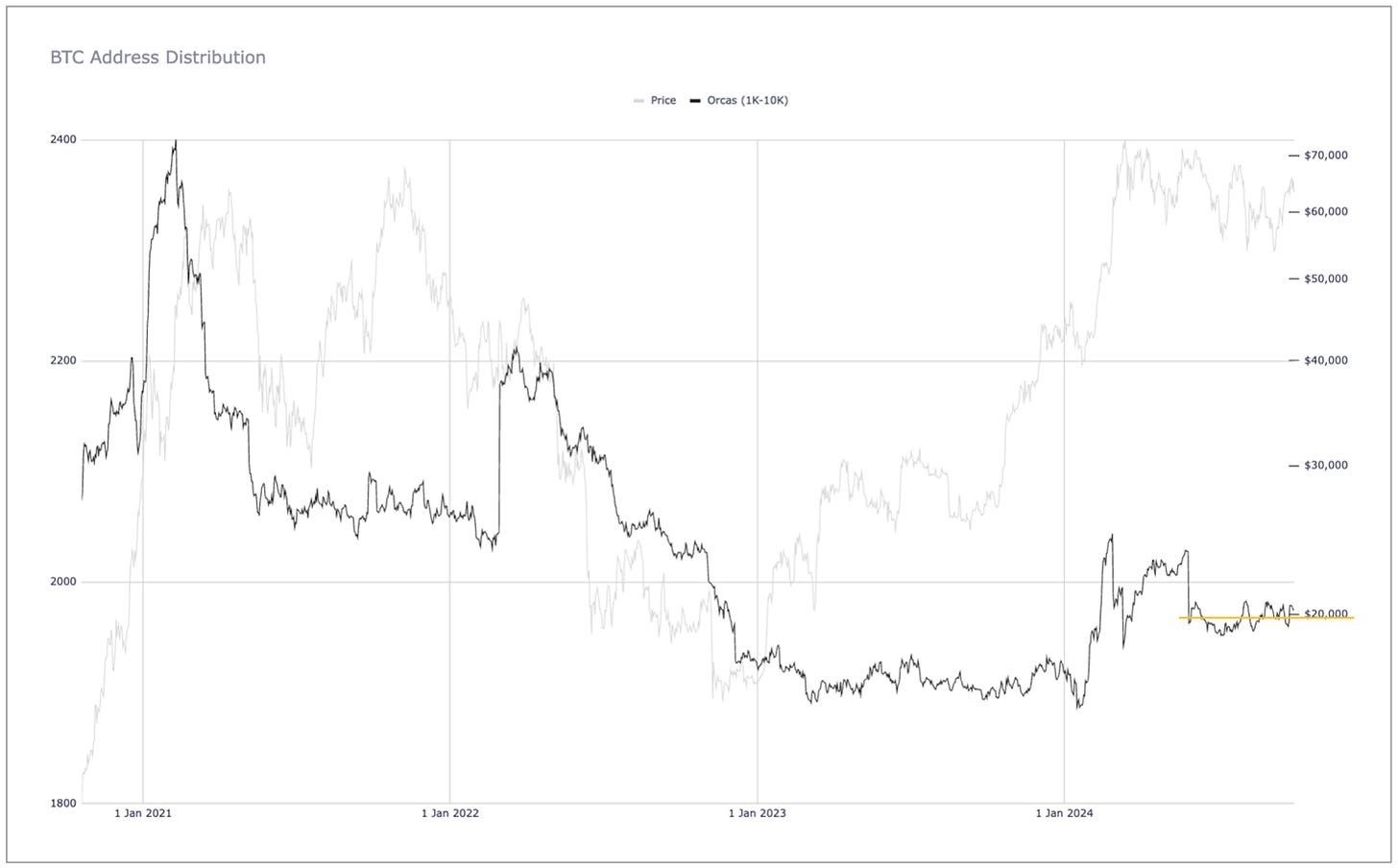

As shown above, two non-exchange Blue Whales (BWs) evolved during September, which is encouraging, but this gain was offset by a net loss of three Orcas along with a staggering 790 sharks (63 Great Whites and 727 Tiger Sharks). The latter three tiers vomited more than 20K coins in September alone, though new and existing non-exchange BWs thankfully absorbed the coins in full, along with about half of the new coins minted in September (retail buyers - Fish and Minnows - bought the other half of the new supply). All of this is to say that institutional money was net-flat during the month, with a bit of supply moving north into BW hands, but overall, institutional demand is simply absent right now. For anyone who has followed me for a while, you know that I firmly believe we will not see any substantial and/or sustainable price gains until whales (and specifically Orcas) start pouring in. The data are crystal clear.

The current lack of Orca demand can be seen in the Orca-count graph above. As shown, Orcas have flatlined since April 2024 after a massive runup the first four months of the year. It is little wonder then that price has flatlined as well. I know the most ardent BTC maxis will rejoice in the on-chain address data above, in that Minnows continue expanding by the hundreds of thousands nearly every single month, but for those who care even a little about investment returns, you must understand that we will not see meaningful gains until Orcas start pouring into the market by the dozens. But they will. I just don’t know when.

As I think I have made abundantly clear, there is absolutely no BTC/crypto-specific catalyst right now to drive price higher, nor is there one anywhere on the horizon from what I can tell. That said, BTC/crypto-specific catalysts usually appear out of nowhere, so I suspect this will be the case again. i.e., I am perfectly content to wait for the next catalyst to emerge, whenever that may be. I know it will eventually come, and when it does, it will be be splendid. But to think it will come simply because the calendar flipped from September to October or from Q3 to Q4 is absolute poppycock.

In sum, I do believe the next several months will generally be more bullish than bearish simply because of where we are in the new halving cycle. That said, I do not expect any face-melting returns until BTC/crypto recaptures the zeitgeist. Right now, that is reserved for AI, so until it swings back in the direction of BTC/crypto, crypto markets will remain the domain of momentum traders, not hodlers. i.e. Short of catastrophic global/macro news, BTC’s price will remain a function of momentum traders rather than a meaningful change in the number of (institutional) investors who view BTC as the preeminent store of value it is.

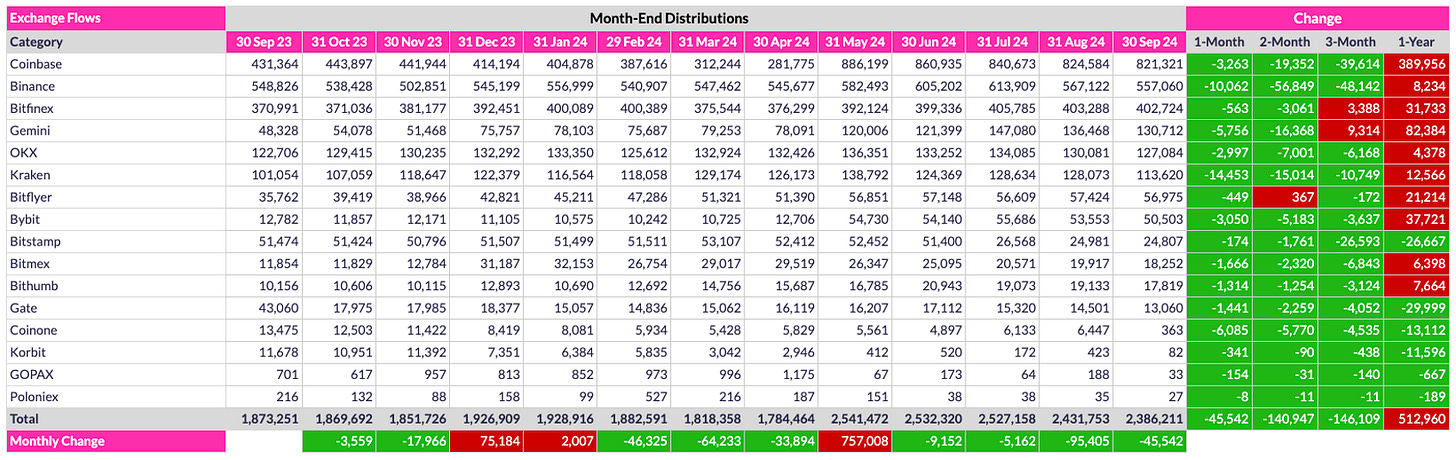

Below are changes in exchange inventory over the past 12 months:

As shown, coins continue leaving exchanges by the tens of thousands, which is extraordinary (NB: The 1-year change data above are skewed by a wallet scrub that Coinglass performed in May 2024). If you look really long term, this trend can be nothing but exhilarating. Not only will the eventual supply shock drive price into the stratosphere, but equally importantly, the world will finally have a truly decentralized medium of exchange, where people transact peer to peer by default. Amazing.

US Exchange Traded Funds (ETFs)

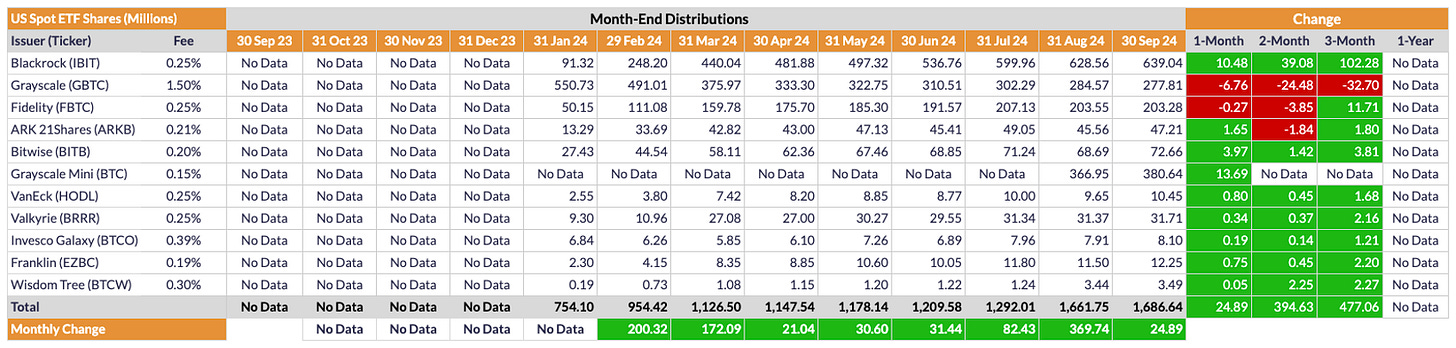

Below are changes in share-count for US spot-BTC ETFs since their launch:

As shown above, most US spot-ETFs continue experiencing inflows with the exception of Grayscale’s GBTC and, somewhat surprisingly, Fidelity’s FBTC. Overall, share gains have been modest recently, but they are still increasing monotonically, so we bulls have little reason to complain. More and more investors arrive at the shores of Bitcoinistan nearly every single day, almost irrespective of PA.

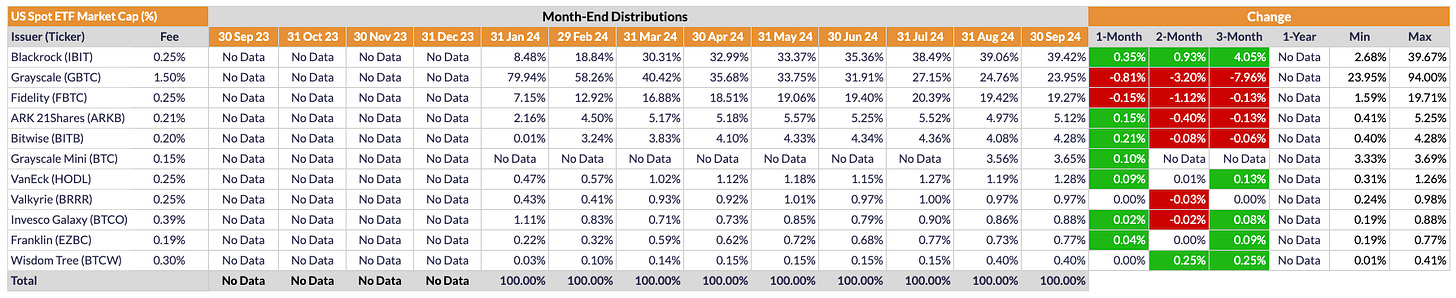

From a slightly different perspective, above is the relative market share of each of the US spot-ETFs. As shown, Blackrock (IBIT) continues expanding its market share, ending September with 39.42% of the total market. That percentage is down ever so slightly from its peak of 39.67%, but it should still eclipse 40% soon, likely in October. Conversely, GBTC is now down to less than 24% share, well off its launch-peak of 94%. On the other hand, Grayscale’s other, newer spot-ETF (BTC) has upped its share to 3.65% of the market since launching in August.

Conclusion

I don’t want to beat a dead horse, so I’ll simply conclude this month’s write-up by saying people should seriously question how much validity they give to any calendar-month predictions they come across. Just as September surprised many to the upside, October, November and/or December could all surprise to the downside, particularly in the absence of any BTC/crypto-specific news/catalysts. i.e., As long as traders dominate the market, price will continue getting yanked around, usually unexpectedly and certainly unpredictably. On the other hand, if I have learned nothing in the past five years, I have learned that market catalysts typically emerge out of nowhere, both up and down, so it is usually best to just sit tight and wait for the gains to come to you rather than chasing them up and down. Not financial advice, of course, but certainly the strategy that has worked best for me personally. Whatever you decide, good luck to you with your own investing, and of course…

Go #BTC.